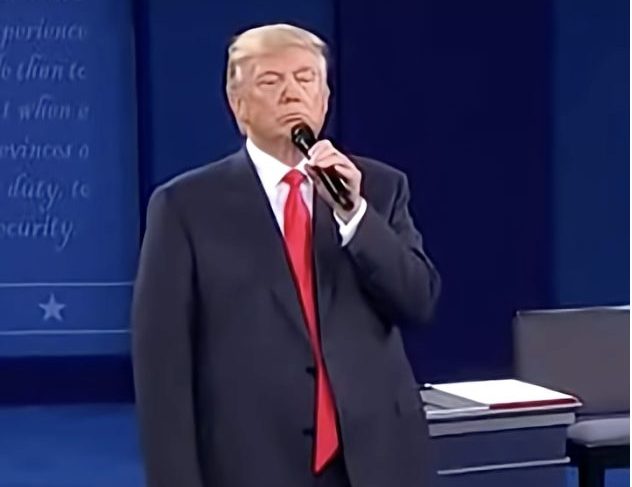

Trump didn’t just admit to a massive business failure that day. He revealed how the ultra-wealthy view the tax code not as a burden but as a strategic opportunity. “That makes me smart,” he said, and while many found this offensive, he was simply acknowledging what I’ve observed throughout my career working with successful entrepreneurs.

The wealthy don’t fear taxes. They understand them.

Turning Losses Into Assets

What Trump demonstrated was the power of tax loss carryforwards – a completely legal provision that allows business losses to offset future income for years. That $916 million loss wasn’t just a financial disaster; it became a valuable asset that protected future earnings from taxation.

This isn’t tax evasion. It’s tax strategy. And it’s available to business owners at every level, not just billionaires.

I’ve been in rooms with billionaire tax attorneys, and I can tell you they don’t operate by breaking rules. They operate by mastering them. The difference between their approach and what most Americans do is night and day.

The Tools Most People Never Use

The wealthy use sophisticated but perfectly legal strategies that your average CPA rarely discusses, including:

- Income reclassification techniques

- Depreciation schedules that maximize deductions

- Strategic use of business entities (LLCs, C Corps, S Corps)

- Section 179 deductions for business equipment

Consider this practical example: If you purchase a $75,000 business vehicle while in the highest tax bracket, you can potentially deduct the full amount in one year under Section 179. That’s a $27,000 tax break on something you needed to buy anyway.

Most business owners I meet have never maximized these opportunities because they’ve never been taught how the game is really played.

The Knowledge Gap Is Deliberate

There’s a reason most Americans don’t understand these strategies. Our educational system teaches virtually nothing about taxation, and most tax professionals are trained to process returns, not to strategize.

When I became a millionaire by age 26, it wasn’t because I had special privileges. I simply learned the rules of the game and applied them consistently. The tax code isn’t written to punish the wealthy – it’s written to incentivize certain behaviors that lawmakers want to encourage, particularly business investment and job creation.

The wealthy don’t have access to different rules. They just have better knowledge of the existing ones.

Change Your Mindset, Change Your Results

The first step toward better tax outcomes isn’t hiring an expensive attorney. It’s changing how you think about taxes.

Stop viewing taxes as something to fear or merely comply with. Start seeing the tax code as a roadmap with directions to financial advantage. This shift in perspective is what separates those who constantly complain about taxes from those who strategically minimize them.

The wealthy don’t ask “How do I pay my taxes?” They ask “How does the tax code want me to operate my financial life?”

This isn’t about politics or fairness debates. It’s about financial literacy and using the system as designed. The tax code is complex by nature because it’s trying to influence economic behavior in countless ways. That complexity creates opportunity for those willing to understand it.

So while others were busy attacking Trump for his tax strategy, they missed the real lesson: The rules are available to everyone, but only those who study them can use them effectively. Stop fearing taxes and start understanding them. The same strategies used by the wealthy are waiting for you too – if you’re willing to learn them.