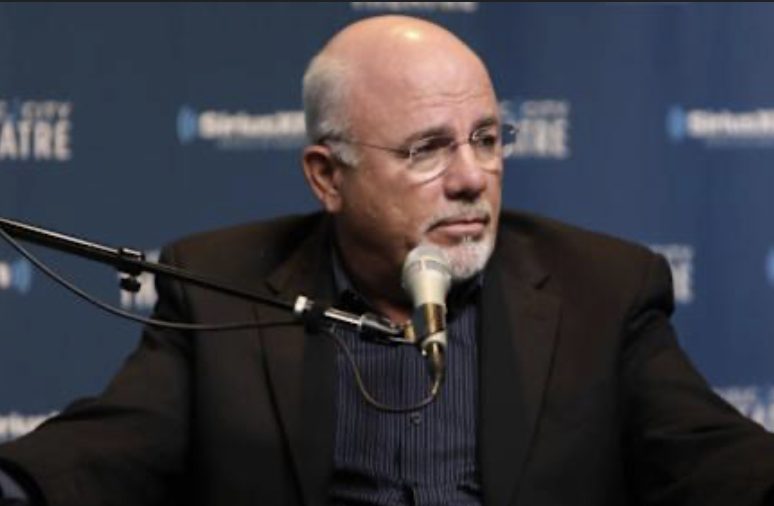

Dave Ramsey, the popular personal finance author and radio host, sounds an alarm about the urgency of understanding Social Security benefits and ways to handle the financial transition into retirement years. Ramsey emphasizes the importance of careful planning for Social Security in retirement, warning that relying solely on these benefits may not be enough to maintain financial stability.

Ramsey highlights the fact that Social Security often falls short of covering living expenses comfortably, making it essential for retirees to supplement their income with savings and investments such as 401(k)s and IRAs (Individual Retirement Accounts).

Ramsey also cautions against claiming Social Security benefits too early while still working, as doing so can lead to temporary reductions in payments. For instance, in 2024, benefits were reduced by one dollar for every two dollars earned beyond an annual income threshold of $22,320. However, these deductions are not permanently lost — they are withheld until a person reaches full retirement age, typically 67.

Ramsey urges people to pay attention to the importance of considering healthcare costs, as Medicare does not cover all medical expenses, leaving retirees responsible for additional costs such as long-term care. His advice encourages Americans to take a proactive approach to retirement planning, ensuring they have a well-rounded financial strategy that accounts for potential gaps in Social Security coverage and rising healthcare expenses. Ramsey bluntly explains that Social Security’s trust funds are projected to run out by 2034, which could lead to a reduction in monthly benefits to about 80% of what retirees currently expect if lawmakers fail to intervene.

He stresses that Social Security was never intended to be the primary source of retirement income but rather a supplement to personal savings.

Social Security planning for retirement

Ramsey advises people to take control of their financial future by consistently contributing to employer-sponsored 401(k) plans and tax-advantaged IRAs throughout their careers.

He urges people to start saving early and not to rely entirely on Social Security. “Don’t count on it,” he cautions. His message reinforces the importance of proactive retirement planning to ensure financial stability beyond Social Security’s uncertain future.

The number of workers supporting each Social Security recipient was 2.7 in 2023, but by 2035, that ratio is expected to drop to 2.4 as millions of baby boomers enter retirement. This shift will put increased pressure on the system and could impact future benefits. Ramsey advises Americans to carefully consider whether to claim Social Security benefits early at a reduced amount or wait until full retirement age (or later) for larger monthly payments.

Because this decision is permanent, he stresses the importance of weighing financial needs and longevity when planning for retirement income. Ramsey suggests that claiming benefits sooner is often a better strategy, as Social Security payments stop upon death (except for cases involving surviving family members), meaning retirees should take advantage of them while they can. He encourages those who do not rely on Social Security for basic expenses to invest their payments to grow their wealth.

For example, a retiree eligible for $1,500 per month at age 67 would receive $1,050 monthly at 62 or $1,860 at 70, making timing a key factor in financial planning.