July 28, 2025

Last Updated: July 28, 2025

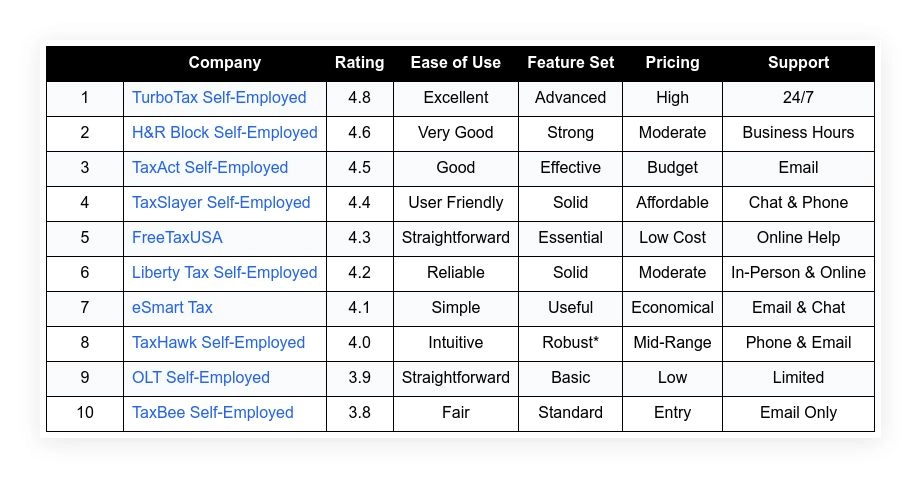

This list serves to aid self-employed individuals in finding the most reliable tax software for their needs in 2025. It offers clear information and data-based insights that can help readers make informed decisions. The self-employed face unique tax challenges, and these tools have been selected after careful review and testing. The evaluation process considered several key aspects that impact user experience and effectiveness. The main criteria used include:

- Ease of Use

- Feature Set

- Pricing

- Customer Support

- Accuracy and Reliability

Each software option has been rated on these measures to ensure self-employed users receive the best possible guidance in managing their taxes.

Top 10 Tax Software For Self Employed In 2025

TurboTax Self-Employed

TurboTax Self-Employed stands out for its user-friendly interface and powerful features. It assists self-employed professionals with a guided approach to taxes. The software simplifies deductions and expense tracking. Reviews point to its ease in handling complex tax forms. It offers useful educational resources and tips specific to freelancers and contractors. The platform ranks high on reliability for managing tax returns digitally. Users appreciate the step-by-step instructions that help in avoiding common mistakes. The tool also integrates with various financial apps, which streamlines the overall process.

Ease of Use: Highly intuitive

Feature Set: Extensive

Pricing: Premium

Support: 24/7 availability

Accuracy: Top-rated

| Summary of Online Reviews |

|---|

| Users remark with “exceptional guidance” while many highlight the careful detail provided throughout the filing process. |

H&R Block Self-Employed

H&R Block Self-Employed is known for its balanced mix of support and functionality. It offers guidance tailored to independent contractors and freelancers. The tool provides live assistance during tax season and steps to optimize deductions. Its design is straightforward, catering well to users who prefer clear navigation. Clients report satisfaction with the ease of access to professional help and quality resources. The service also includes options for both online and in-person support when needed. Overall, it meets the needs of self-employed individuals with a reliable digital filing system.

Ease of Use: Very user friendly

Feature Set: Solid

Pricing: Moderate

Support: Business hours with live options

Accuracy: Reliable

| Summary of Online Reviews |

|---|

| Feedback often notes “clear explanations” and trustworthy assistance that enhance overall satisfaction. |

TaxAct Self-Employed

TaxAct Self-Employed is designed for simplicity and effectiveness. It focuses on reducing the time needed to complete tax returns. The service streamlines the process with a clean interface and guides specific to self-employed tax situations. Users find that it balances affordability with necessary features. The system offers detailed instructions, making it easier for individuals with varying levels of tax knowledge. Its value lies in providing essential tools without overcomplicating the filing process. This option is appreciated for its clarity and uptight focus on what matters most during tax season.

Ease of Use: Good

Feature Set: Effective

Pricing: Budget-friendly

Support: Email based

Accuracy: Dependable

| Summary of Online Reviews |

|---|

| Users mention “time-saving features” alongside clear instructions that simplify tax filing. |

TaxSlayer Self-Employed

TaxSlayer Self-Employed offers an interface that favors speed and clarity. It is geared toward users who want a straightforward and prompt filing process. The platform reduces unnecessary steps while still providing ample guidance for deductions and record keeping. Many self-employed users praise its balance between cost and functionality. Its design and navigation improve the filing experience, even for those with limited tax knowledge. The tool provides real-time calculations and error checks, which boost confidence during preparation. Its pricing model also makes it attractive to budget-conscious individuals.

Ease of Use: User friendly

Feature Set: Solid

Pricing: Affordable

Support: Chat and phone assistance

Accuracy: Consistent

| Summary of Online Reviews |

|---|

| Reviews highlight “prompt support” and easy navigation that many find satisfactory. |

FreeTaxUSA

FreeTaxUSA offers a solid option for self-employed filers on a budget. Its interface is straightforward and delivers essential tools for filing. It focuses on providing key functionalities without unnecessary extras. The platform is appealing for those who need to manage basic tax needs efficiently. Users appreciate the low-cost option combined with reliable performance. The software handles all required forms and integrates deduction guidance specifically for independent professionals. This approach caters to individuals who do not require extensive features but still value a clear filing process.

Ease of Use: Straightforward

Feature Set: Essential

Pricing: Low cost

Support: Online support

Accuracy: Trustworthy

| Summary of Online Reviews |

|---|

| Users often state “great value for money” and emphasize the no-nonsense approach in tax preparation. |

Liberty Tax Self-Employed

Liberty Tax Self-Employed caters to independent professionals who prefer a blend of digital assistance and personal service. The software provides tools that address the specific needs of freelancers and contractors. It includes a guided process to help users optimize their tax deductions. The platform allows access to digital filing as well as options to consult live specialists. This combined approach offers an appealing mix of technology and human support. Many users find its structure reliable for both simple and more intricate tax cases, making it a dependable option for self-employed tax filers.

Ease of Use: Reliable

Feature Set: Focused

Pricing: Moderate

Support: In-person & digital

Accuracy: Consistent

| Summary of Online Reviews |

|---|

| Feedback includes “personalized support” with many users praising the balanced approach between online and offline help. |

eSmart Tax

eSmart Tax offers a no-frills approach that suits self-employed individuals looking for efficiency. The interface is clear and free of unnecessary distractions. It guides users through the tax preparation steps with relevant tips and prompts. This software emphasizes essential tax tools and ensures that users cover all required details. Its straightforward process helps reduce filing errors while being mindful of cost. Users favor the minimalistic design that remains effective for processing returns quickly. It is a practical choice for those who prefer a direct method to manage their tax filing.

Ease of Use: Simple

Feature Set: Focused

Pricing: Economical

Support: Online chat and email

Accuracy: Reliable

| Summary of Online Reviews |

|---|

| Users comment with “straightforward filing” and admire the clear-cut guidance provided throughout the process. |

TaxHawk Self-Employed

TaxHawk Self-Employed targets users who need a well-organized digital tax solution. Its layout emphasizes quick data entry and minimizes complications during filing. The software is built to handle tax forms and deductions common among freelancers. Users benefit from the clarity of instructions and the efficiency of its error-checking features. It serves independent contractors with tools that enhance data accuracy and streamline the overall process. Its pricing is set at a mid-range level, making it accessible for many self-employed users. The digital support options further enhance its usability.

Ease of Use: Intuitive

Feature Set: Solid

Pricing: Mid-range

Support: Phone and email

Accuracy: Dependable

| Summary of Online Reviews |

|---|

| Clients state “efficient processing” and mention minimal errors as strong points of the platform. |

OLT Self-Employed

OLT Self-Employed is tailored for users who need a basic, no-frills tax filing experience. It covers all essential forms while keeping the process direct. The system is designed to minimize confusion and focuses on delivering a quick return filing. Users have noted that it handles primary tax deductions effectively. It is an appealing option for individuals with uncomplicated tax situations who value simplicity. While its features are straightforward, it meets the needs of many self-employed filers. Its support structure is minimal, which suits those comfortable with digital guides.

Ease of Use: Straightforward

Feature Set: Basic

Pricing: Entry-level

Support: Limited

Accuracy: Sufficient

| Summary of Online Reviews |

|---|

| Reviews mention “adequate performance” and refer to it as a no-frills option that covers the basics. |

TaxBee Self-Employed

TaxBee Self-Employed offers a modest solution designed for the independent worker. It simplifies the tax preparation process by focusing on key filing tasks. The interface is serviceable and concentrates on filling out forms accurately. Many users find it a practical choice if their tax situation is uncomplicated. Its pricing is accessible, making it a viable option for those mindful of cost. While the software lacks extra features, its straightforward approach appeals to self-employed users seeking a direct filing experience. The service meets basic needs and is well-suited for simple returns.

Ease of Use: Fair

Feature Set: Standard

Pricing: Entry-level

Support: Email support only

Accuracy: Adequate

| Summary of Online Reviews |

|---|

| Comments include “satisfactory for simple returns” with users noting the value in affordability. |

Final Thoughts

Patterns across these tax solutions reveal careful attention to essential needs. Self-employed users can benefit from platforms offering clarity, dedicated support, and exact guidance. The range from premium to entry-level pricing ensures there is a tool suited for multiple budgets. Decision makers may choose a solution based on how well the interface and support options match their work style. Each option has its strengths and caters to different levels of tax complexity. Readers are encouraged to match the software’s features with their own filing needs to select the best match for their business.