The Dangerous Myth of Mortgage Prepayment

I’ve studied the events of the 2008 housing crisis extensively. What I discovered was shocking: banks foreclosed on people with 40-50% equity because they knew they could recover their money. This reveals a crucial truth: banks protect their profits, not yours.

When homeowners follow Dave Ramsey’s advice to pay down mortgages aggressively, they create what I call “equity gel” — money trapped in their homes that becomes inaccessible during financial emergencies. This approach left thousands of homeowners vulnerable during the 2008 crash.

Never make extra payments on your mortgage. This might sound counterintuitive, but it’s the first rule of smart mortgage management. Every dollar you send to the bank in extra principal payments is a dollar you no longer have control over.

Maximizing Control and Flexibility

Banks don’t want you to know this, but longer mortgage terms actually give you more financial control. Here’s my approach to mortgage strategy:

- Choose a thirty-year mortgage or an interest-only mortgage over shorter terms, like fifteen years

- Keep your money liquid and accessible instead of trapped in home equity

- Focus on cash flow investments you understand and can control

- Use your money to acquire assets that generate income rather than getting trapped by “dead equity.”

Even if you can afford higher payments on a shorter-term mortgage, the flexibility of lower required payments gives you options during economic downturns or personal financial challenges. This approach saved many of my clients during the 2008 crash.

The Real Path to Building Wealth

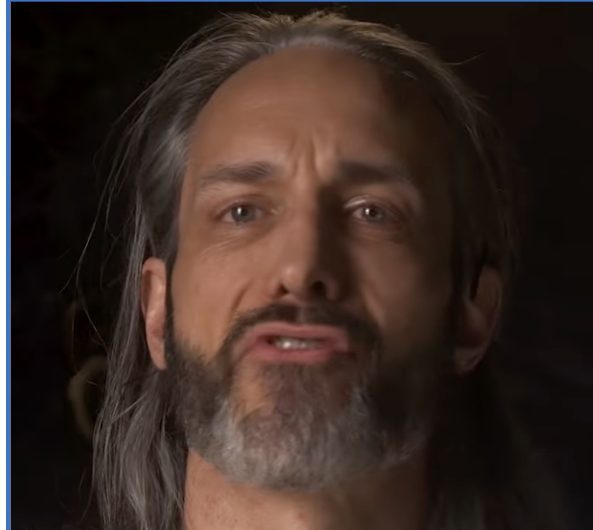

I became a multimillionaire by age twenty-six, not by following conventional financial advice, but by understanding how money and banking actually work. The strategies I teach in my book, “Killing Sacred Cows,” challenge popular financial myths that prevent most Americans from building true wealth.

While Dave Ramsey focuses on debt elimination, I focus on cash flow creation. This fundamental difference in philosophy explains why Robert Kiyosaki endorses my work – we both understand that not all debt is created equal.

This approach saved my clients during the 2008 crash, and I was featured on Fox News warning about the coming housing crisis.

The wealthy use strategic debt as leverage to acquire income-producing assets. They understand that mortgage interest rates are often among the lowest available, and the tax benefits can make mortgages even more attractive as wealth-building tools.

A Better Approach to Home Financing

My mortgage strategy centers on maintaining control of your capital. Instead of pouring extra money into mortgage payments, direct those funds toward investments you understand and can influence directly.

This doesn’t mean avoiding homeownership – quite the opposite. Real estate remains one of the most powerful wealth-building tools available, but the way you finance property makes all the difference.

I coach elite business owners to think differently about their homes and mortgages. Your home isn’t just a place to live – it’s a financial tool that, when used correctly, can accelerate your journey to financial independence.

The next time you hear someone advise you to pay off your mortgage early, remember that the truly wealthy do exactly the opposite. They maintain liquidity, maximize flexibility, and use their capital to generate income rather than eliminate low-cost debt.

This perspective might challenge everything you’ve been taught about mortgages, but it’s the approach that has created financial freedom for my clients and me. Sometimes, the most valuable financial advice goes against conventional wisdom.