Jimmy Buffett’s widow, Jane Buffett, has filed a petition in a Los Angeles court to remove her co-trustee, Richard Mozenter, from the marital trust created to support her after the singer’s death in 2023. Jane Buffett alleged that Mozenter has been “openly hostile and adversarial” toward her and has refused to give her details on the trust and its financials. Mozenter has filed his own lawsuit alleging that Jane has been “completely uncooperative” in his efforts to manage the trust.

He said Jane has interfered in business decisions, refused to meet with Mozenter, and breached her fiduciary duties by “acting in her own interest.”

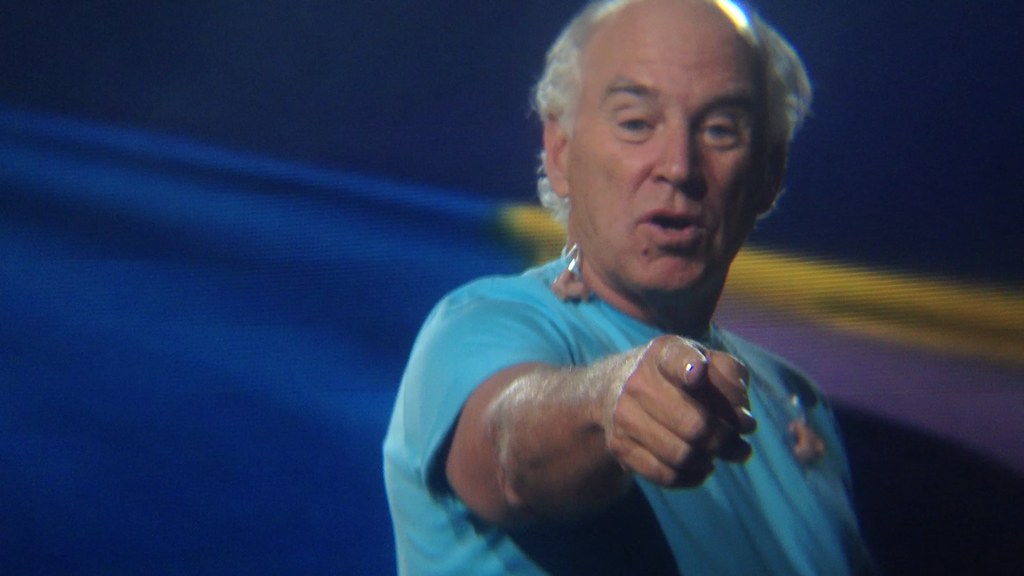

The case has put a spotlight on the estate plans and business empire left by Jimmy Buffett, famous for hits like “Margaritaville” and “Cheeseburger in Paradise.” Along with his song catalogue, Buffett left homes, cars, planes, and a multimillion-dollar stake in his brand business. According to the filings, the assets Buffett left included $34.5 million in real property, $15 million in equity in a company called Strange Bird Inc., $2 million in musical equipment, $5 million in vehicles, and $12 million in other investments. One of the largest assets is Buffett’s stake in Margaritaville, the chain of restaurants, bars, hotels, and merchandise that commercialized the Buffett lifestyle.

Buffett’s equity in Margaritaville was estimated at $85 million, held through JB Beta. In her complaint, Jane Buffett said Mozenter refused to provide her with basic financial information about the trust. She said his fees of $1.7 million a year to manage the trust were “enormous.” When she asked for her projected income from the trust, Mozenter continued to delay.

Finally, after enlisting the help of her friend Jeff Bewkes, the former Time Warner chief, Mozenter provided her with an estimate of $2 million a year.

Jimmy Buffett trust dispute escalates

Trust lawyers said the case is part of a growing wave of lawsuits related to inheritances and trusts.

More wealth being passed down means more litigation, as families often fight over who gets what. The Buffett case reflected a different but equally common source of disputes: dueling trustees. Since the lawsuits were filed in different states, courts will first have to decide where the case will be heard.

After that, a judge will start arguments and ultimately decide a path forward. Attorneys said judges have typically sided with the outside trustee (in this case Mozenter). Yet increasingly, they have been siding with spouses — which could mean Mozenter is removed.

Attorneys said the Buffett case offers two important lessons for families planning wealth transfers. First, wealth holders should communicate the plans for their estates before they die so no one is surprised. Second, friends or business associates don’t always make good trustees.

While today’s wealthy often name a trusted friend to a family trust, the trustee may have a different relationship with the beneficiary and can see themselves as carrying out the wishes of the deceased.