July 28, 2025

Last Updated: July 28, 2025

This list serves to guide self-employed professionals who are exploring viable alternatives to Turbotax in 2025. It offers clear insights and factual details to help users find tax software that fits their needs. The alternatives listed have been selected based on performance data and user feedback in recent years. The evaluation is based on specific criteria that highlight important aspects of each option.

Key evaluation criteria include:

- Ease of Use

- Pricing Structure

- Customer Support

- Features and Tools

- Overall User Satisfaction

Top 10 Turbotax Alternatives For Self Employed In 2025

H&R Block Self-Employed

H&R Block Self-Employed provides a reliable platform designed for freelance professionals and small business owners. The service offers clear instructions and solid support throughout the filing process. The interface is straightforward and supports a range of tax situations. Users find the built-in tools helpful for spotting potential deductions. The system allows access to professional review if needed. Data security and accuracy remain priorities. Reviews emphasize the ease of navigation combined with strong customer service.

Ease of Use: 9/10

Pricing: Moderate

Customer Support: 9/10

Feature Set: Extensive tools

User Satisfaction: High

| Summary of Online Reviews |

|---|

| Users have noted, “The service is efficient and the support team is very responsive.” Many praise its ease of navigation and thorough review options. |

TaxAct Self-Employed

TaxAct Self-Employed is known for a user-friendly design and affordable pricing. The platform offers step-by-step instructions with guides tailored for self-employed individuals. It provides essential tools to manage deductions and handle various tax scenarios. Users enjoy the simplicity and clarity of the design. The service also supplies detailed help resources that aid in tax filing. Data indicates a positive response from users who appreciate the balance between cost and features.

Ease of Use: 8/10

Pricing: Affordable

Customer Support: Good

Feature Set: Clear guidance

User Satisfaction: Positive

| Summary of Online Reviews |

|---|

| Reviews include comments such as “The interface is clear and the process is streamlined.” Users highlight its affordability and reliable support. |

FreeTaxUSA

FreeTaxUSA offers a low-cost option that is ideal for self-employed individuals on a budget. The platform provides free federal filing and nominal fees for state filing. Its straightforward user interface helps users complete tax returns with ease. The tool guides users through potential deductions appropriate for independent professionals. It emphasizes secure processing and accuracy. Feedback often mentions that the service meets the basic needs of many self-employed individuals while keeping costs low.

Ease of Use: 8/10

Pricing: Low Cost

Customer Support: Satisfactory

Feature Set: Budget features

User Satisfaction: Favorable

| Summary of Online Reviews |

|---|

| Feedback often notes, “A reliable option that doesn’t break the bank.” Many users appreciate its cost efficiency and simplicity. |

TaxSlayer

TaxSlayer presents a solution noted for its ease and speed. The platform helps self-employed users navigate tax filing with clear options. It provides guided steps and useful tools to handle complex tax situations. The setup is designed for quick completion without extensive technical details. Users find the service efficient and value the additional resources for maximizing deductions. Performance data show that many self-employed customers value its balance between functionality and price.

Ease of Use: 8.5/10

Pricing: Moderate

Customer Support: Responsive

Feature Set: Guided steps

User Satisfaction: High

| Summary of Online Reviews |

|---|

| Users report, “The process is quick and the instructions are straightforward.” The service receives praise for its efficiency and clear interface. |

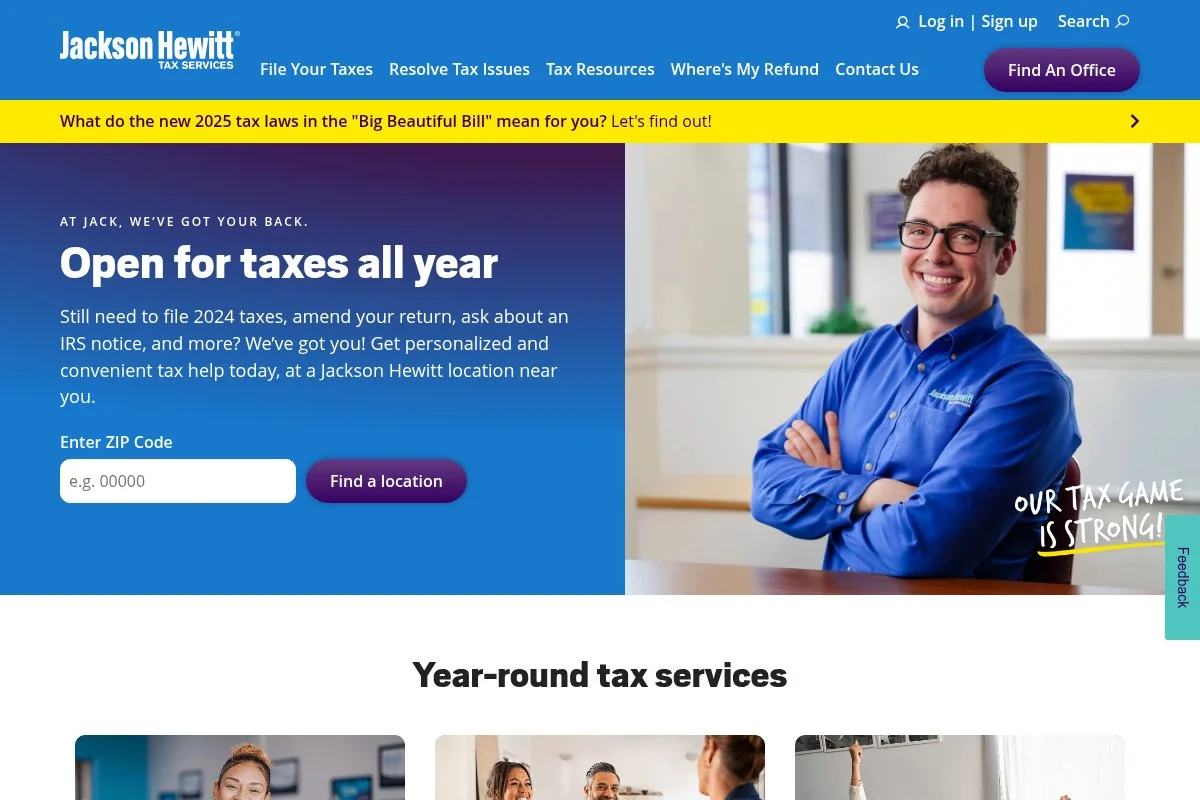

Jackson Hewitt

Jackson Hewitt offers a trusted option that emphasizes both in-person and online help. The platform supports self-employed individuals with guided filing and personal assistance when needed. Its tools help users locate appropriate credits and deductions. The interface is built to minimize error while providing clear instructions. Many customers value the option for expert review and the blend of digital and human support. The process is structured so that self-employed taxpayers can confidently complete their returns.

Ease of Use: 7.5/10

Pricing: Higher End

Customer Support: Comprehensive

Feature Set: Assisted filing

User Satisfaction: Consistent

| Summary of Online Reviews |

|---|

| Reviewers say, “I appreciate the blend of online convenience and personal support.” The service is highlighted for its reliable assistance during complex filings. |

Cash App Taxes

Cash App Taxes provides a solution with no fees for federal filings. It caters to self-employed users looking for a simple way to file returns without extra costs. The interface is clear and easy to follow. Tools in the platform help users identify applicable deductions. It supports fast processing and accurate calculations. Many users appreciate the cost-free model and straightforward approach. The service has received positive remarks for its efficiency and modern design.

Ease of Use: 9/10

Pricing: Free

Customer Support: Efficient

Feature Set: Basic yet effective

User Satisfaction: High

| Summary of Online Reviews |

|---|

| Users mention, “Filing is quick and simple, and I appreciate that it is free.” Feedback highlights its cost efficiency and ease of use. |

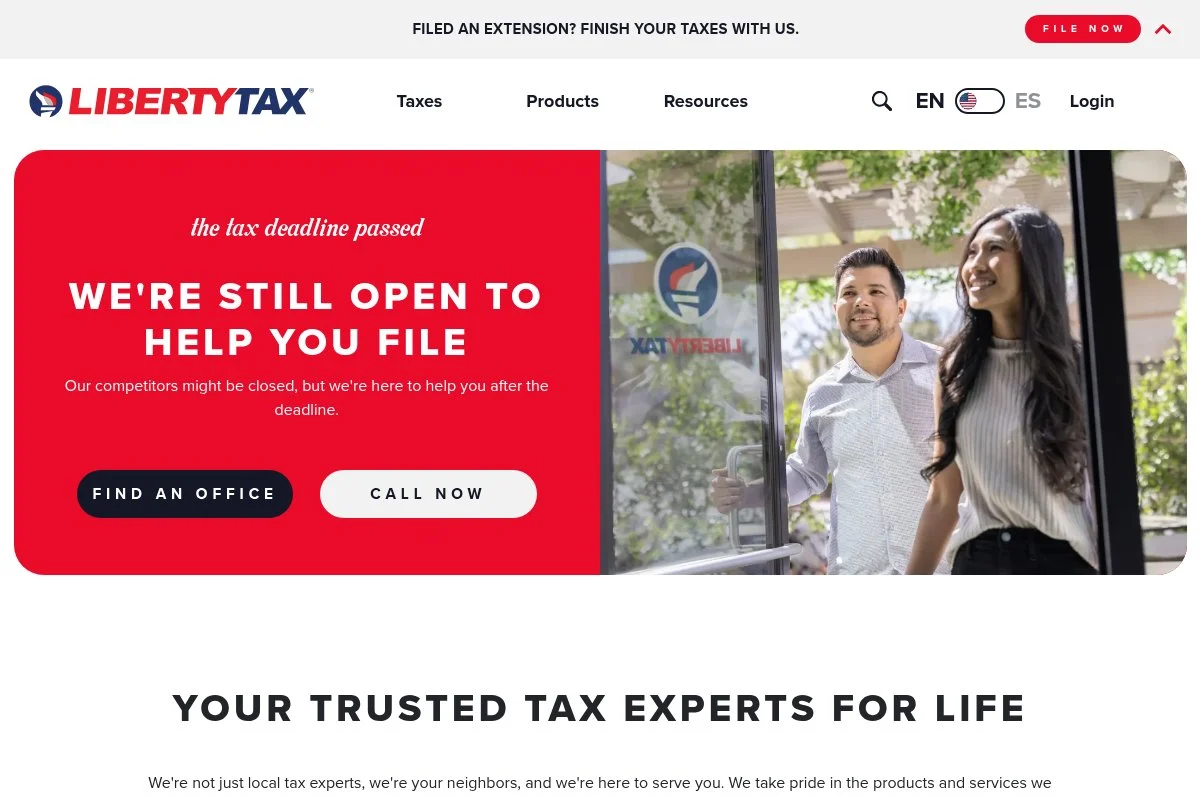

Liberty Tax

Liberty Tax provides an option that focuses on clear digital filing with optional in-person support. The online tools assist with identifying deductions for self-employed taxpayers. The process is straightforward and built to limit errors. Many users value the clarity of instructions and the extra guidance available if needed. The platform balances cost and service quality. Its tools help users complete returns efficiently. Data and user remarks suggest a steady performance that supports varied tax needs.

Ease of Use: 7.5/10

Pricing: Moderate

Customer Support: Adequate

Feature Set: Guided assistance

User Satisfaction: Steady

| Summary of Online Reviews |

|---|

| Comments include “The interface is clear, and the option for personal review is valuable.” The service is noted for its balanced approach to digital and live support. |

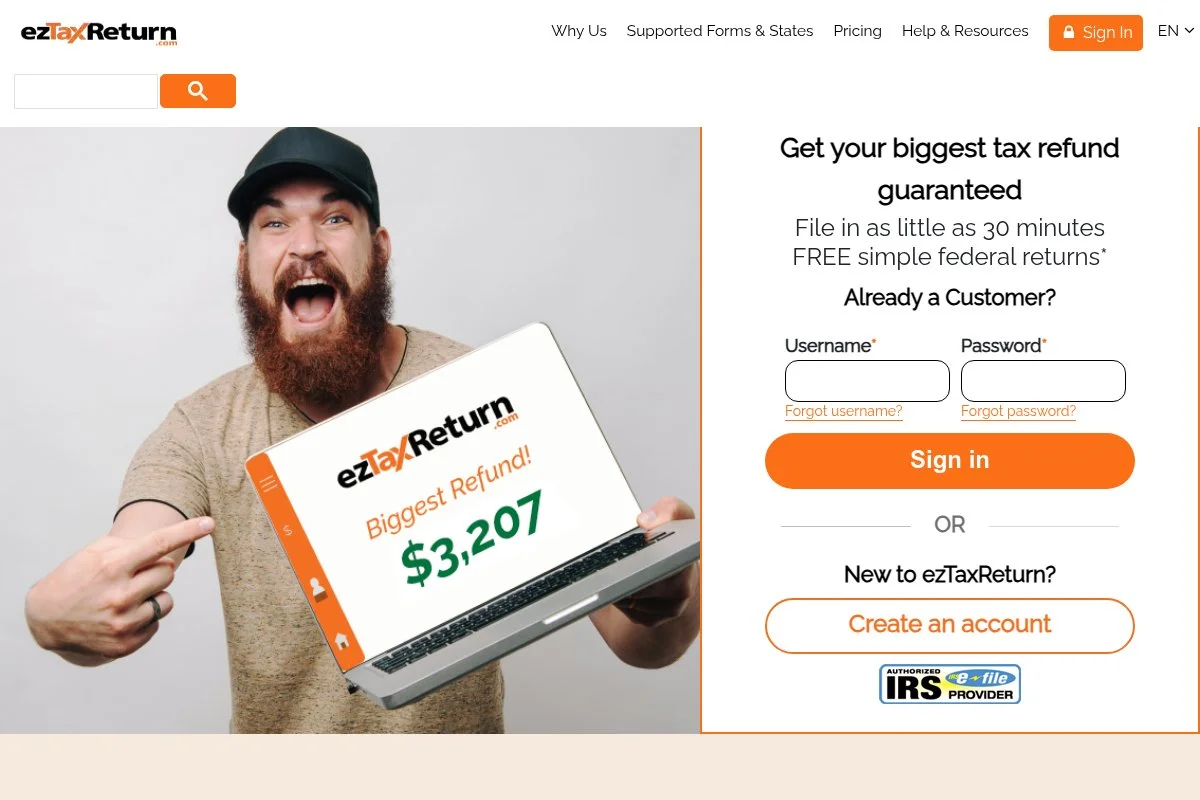

ezTaxReturn Online

ezTaxReturn Online is designed to provide a clear and direct tax filing process suitable for independent workers. The interface is uncomplicated and helps users smoothly navigate the steps required for filing. The platform highlights key tasks and minimizes distractions. Its cost structure is competitive, making it a choice for those who prefer simplicity. The system guides users in claiming self-employed deductions and credits. Many reviews point out the ease of filing and the clarity of instructions.

Ease of Use: 7/10

Pricing: Moderate

Customer Support: Acceptable

Feature Set: Direct process

User Satisfaction: Consistent

| Summary of Online Reviews |

|---|

| Users have stated, “The filing process is straightforward and the instructions are clear enough.” Reviews point to its simplicity and ease of completion. |

TaxHub Self-Employed

TaxHub Self-Employed offers a platform with a range of features designed for independent professionals. Its design is simple yet effective in guiding users through the filing process. The system includes useful tips and reminders for proper deductions. It balances technical details with a friendly user interface. Feedback from the market reflects a stable performance in key areas. Users gain access to detailed toolsets that assist in completing tax forms accurately. The experience is generally consistent and focused on efficient submission.

Ease of Use: 8/10

Pricing: Moderate

Customer Support: Reliable

Feature Set: Detailed tools

User Satisfaction: Solid

| Summary of Online Reviews |

|---|

| Comments include “The platform offers enough details to ensure my tax return is correct.” Users mention its clarity and detailed support. |

FileYourTaxes Online

FileYourTaxes Online is built to simplify tax filing for self-employed individuals. Its step-by-step process supports users in managing deductions and filing returns with minimal hassle. The service offers clear instructions with emphasis on accuracy. It provides essential support for real-time questions during the process. Many users appreciate the balance of cost and functionality. The design caters to those who prefer an easy-to-follow system with helpful hints and reminders. User responses indicate steady satisfaction with both the interface and the available tools.

Ease of Use: 7.5/10

Pricing: Moderate

Customer Support: Accessible

Feature Set: Clear process

User Satisfaction: Reliable

| Summary of Online Reviews |

|---|

| Reviews note, “The process is clear and I felt guided through each step without confusion.” The service is praised for its simplicity and readability. |

Final Thoughts

The options presented offer reliable platforms that meet diverse needs of self-employed professionals. Each service provides unique strengths in design and support to help users file taxes with confidence. Evaluations based on ease of use, pricing, customer support, key features, and user satisfaction help guide decisions. Readers should consider their business scale and preferred level of guidance when choosing the best software. The range of alternatives offers viable pathways to successful tax filing for those who value clarity and cost-effectiveness.