July 28, 2025

Last Updated: July 28, 2025

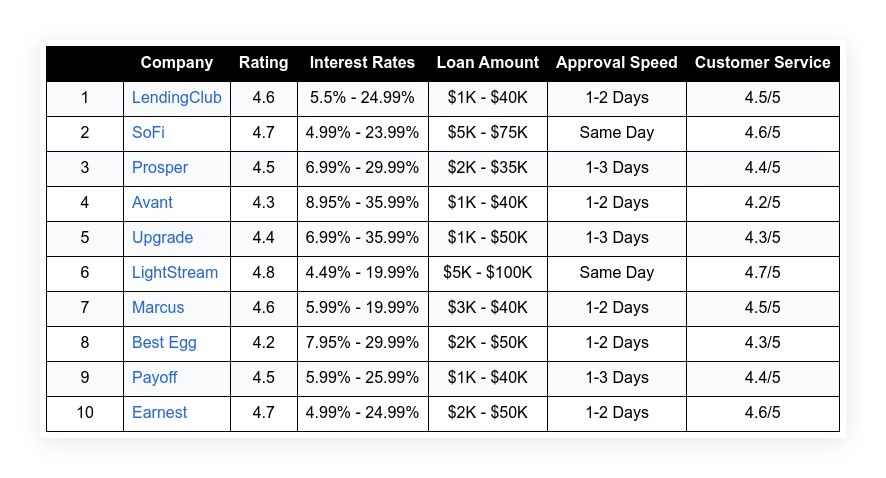

This article lists the top personal loan providers that serve self-employed individuals in 2025. The aim is to offer an analysis that helps borrowers make informed decisions based on performance and service metrics. The self-employed market has grown, and lenders are adjusting their criteria to include alternative income verification methods and flexible underwriting policies. The review shows a trend toward competitive rates, speedy approvals, and reliable customer support. The evaluation is based on several factors that matter most to self-employed applicants. These include:

- Interest Rate Competitiveness

- Flexible Loan Amounts

- Approval Speed

- Approval Rate for Self Employed

- Customer Satisfaction

Each lender is rated on these elements to help borrowers find the service that best fits their business needs.

Top 10 Personal Loan Providers For Self Employed In 2025

LendingClub

LendingClub offers loans with steady terms that meet the needs of self-employed borrowers. Its approval process is tailored to evaluate non-traditional income streams. The platform presents clear criteria and competitive rates. With a straightforward online application, the lender provides reliable feedback on applications. Self-employed clients appreciate the firm’s fair assessment and moderate loan amounts that suit various business sizes. The metrics show solid approval times and favorable customer service ratings. The focus is on making lending decisions based on detailed financial profiles.

Interest Rates: 5.5% – 24.99%

Loan Range: $1K – $40K

Approval Speed: 1-2 Days

Approval for Self Employed: High

Customer Service: 4.5/5

| Summary of Online Reviews |

|---|

| Users mention “clear communication” and note “quick responses” throughout the process. |

SoFi

SoFi stands out for its modern interface and tailored offerings for independent professionals. The lender provides flexible options and competitive rates for self-employed individuals. Its application process is intuitive, and borrowers receive real-time updates on the status of their request. SoFi uses a robust system to assess income that may fluctuate. Customers report that the digital experience feels secure and efficient. The emphasis is on transparency and clear terms for each loan contract. This platform combines technology with detailed financial reviews, offering a streamlined experience.

Interest Rates: 4.99% – 23.99%

Loan Range: $5K – $75K

Approval Speed: Same Day

Approval for Self Employed: Very Favorable

Customer Service: 4.6/5

| Summary of Online Reviews |

|---|

| Customers praise the platform for “user-friendly design” and mention “efficient processing” of applications. |

Prosper

Prosper offers lending options focused on transparency and speed. Its system caters to the unique financial profiles of self-employed applicants. The data suggests that Prosper provides clear loan terms along with an efficient digital application process. The firm uses modern credit evaluation methods that do not solely depend on traditional income documentation. This approach helps self-employed individuals access reasonable financing amounts. Borrowers report that the online tools make application status tracking simple and straightforward. The service is marked by its steady performance and commitment to fair lending.

Interest Rates: 6.99% – 29.99%

Loan Range: $2K – $35K

Approval Speed: 1-3 Days

Approval for Self Employed: Favorable

Customer Service: 4.4/5

| Summary of Online Reviews |

|---|

| Users comment on the “straightforward application process” and note “clear communication”. |

Avant

Avant delivers loan options with clear, organized terms that suit independent professionals. The lender is known for its detailed assessment of nontraditional income documents. Self-employed clients find value in the speedy online application process and transparent fee structures. Reviews indicate the platform thoughtfully considers varied income proofs, which helps in providing flexible loan sizes. The overall mechanism is structured to maintain consistent service while offering a competitive edge on interest rates. Data confirms that Avant successfully meets the needs of borrowers who have fluctuating revenue streams.

Interest Rates: 8.95% – 35.99%

Loan Range: $1K – $40K

Approval Speed: 1-2 Days

Approval for Self Employed: Moderate

Customer Service: 4.2/5

| Summary of Online Reviews |

|---|

| Feedback highlights “clear disclosure of terms” and “efficient customer support”. |

Upgrade

Upgrade offers loan products designed for borrowers with diverse income profiles. The platform emphasizes an online application that quickly suggests tailored loan options. Self-employed individuals benefit from flexible lending amounts and a digital interface that simplifies document submission. The process is set up with measurable approval times and clearly defined interest ranges. User accounts reflect steady performance in both approval speed and customer care. The company maintains a balance between accessible loan sizes and competitive rates. This data-driven approach benefits individuals working independently.

Interest Rates: 6.99% – 35.99%

Loan Range: $1K – $50K

Approval Speed: 1-3 Days

Approval for Self Employed: Favorable

Customer Service: 4.3/5

| Summary of Online Reviews |

|---|

| Clients appreciate the “streamlined application” with “friendly support”. |

LightStream

LightStream excels with low rate offerings and an efficient digital process. Its service is known for fast decisions and a wide range of loan amounts. The lender provides custom income evaluations to suit self-employed applicants. The policy details are clearly outlined and the online dashboard offers easy application tracking. Client feedback shows high satisfaction with response times and clear repayment plans. The performance data confirms low interest rates and swift approvals, making LightStream a smart option for those requiring speed and value.

Interest Rates: 4.49% – 19.99%

Loan Range: $5K – $100K

Approval Speed: Same Day

Approval for Self Employed: Excellent

Customer Service: 4.7/5

| Summary of Online Reviews |

|---|

| Reviewers mention “exceptionally low rates” with “rapid approvals”. |

Marcus

Marcus is known for its clarity and reliability in personal lending. The platform offers structured repayment plans and straightforward terms. Its review process handles various income types, which is helpful for self-employed borrowers. The firm displays stable interest rates paired with competitive loan limits. Borrowers can track their application status online and receive timely responses. The service is built around clear guidelines and a balanced assessment strategy that benefits professionals managing irregular income flows.

Interest Rates: 5.99% – 19.99%

Loan Range: $3K – $40K

Approval Speed: 1-2 Days

Approval for Self Employed: Consistent

Customer Service: 4.5/5

| Summary of Online Reviews |

|---|

| Feedback describes the service as “transparent and reliable” with “detailed support”. |

Best Egg

Best Egg presents personal loans with a focus on simple terms and rapid decisions. The platform is set up to handle applications from self-employed professionals effectively. Its automated review process helps speed up the approval without sacrificing accuracy. The system offers moderate loan amounts and interest rates that suit varied borrower profiles. The straightforward online interface is designed for ease of use and quick feedback. Customer evaluations reflect satisfaction with the clear process and timely updates.

Interest Rates: 7.95% – 29.99%

Loan Range: $2K – $50K

Approval Speed: 1-2 Days

Approval for Self Employed: Good

Customer Service: 4.3/5

| Summary of Online Reviews |

|---|

| Customers note “efficient processing” paired with “clear loan guidelines”. |

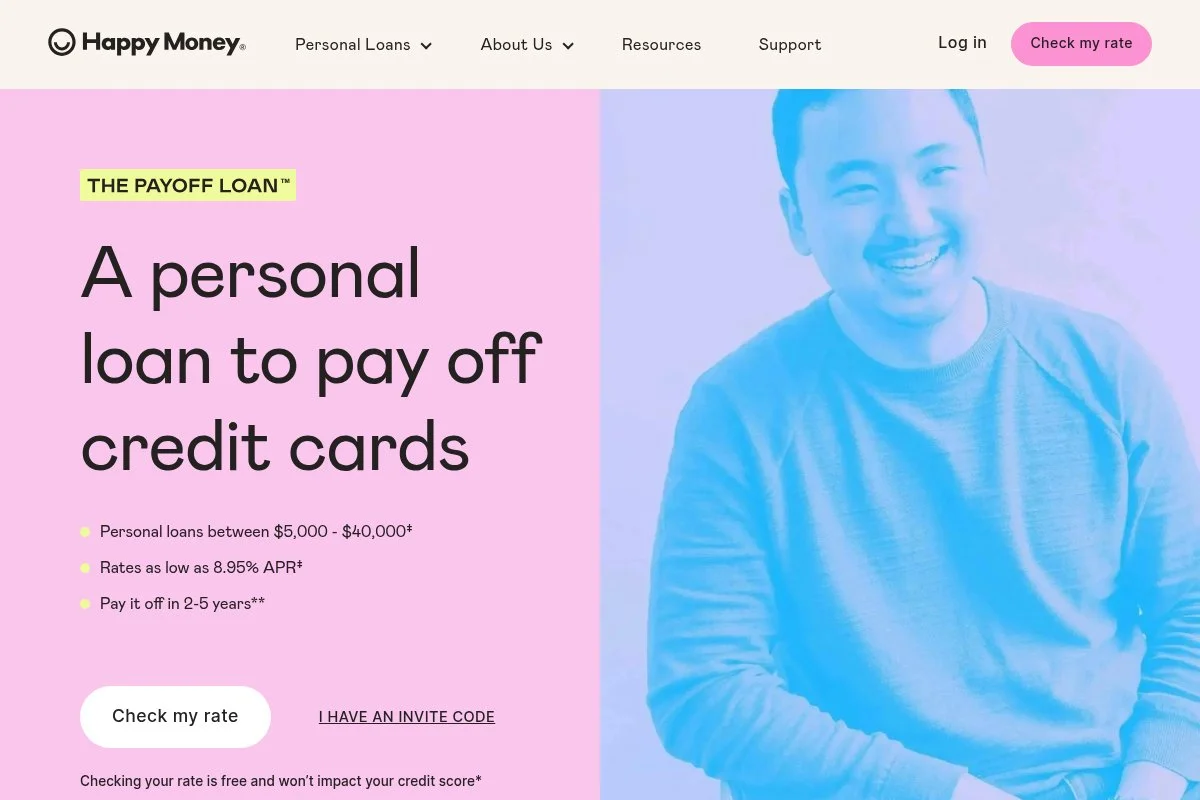

Payoff

Payoff provides specialized solutions for managing debt through personal loans. The lender caters to self-employed individuals by offering a clear pathway to consolidate financial obligations. With defined interest structures and competitive repayment terms, the service has a data-driven focus. The application process is conducted online, ensuring that all relevant documentation is easily uploaded and verified. Borrowers appreciate that Payoff offers personalized guidance alongside a systematic digital review. The metrics in use provide transparency and set achievable credit conditions.

Interest Rates: 5.99% – 25.99%

Loan Range: $1K – $40K

Approval Speed: 1-3 Days

Approval for Self Employed: Competitive

Customer Service: 4.4/5

| Summary of Online Reviews |

|---|

| Reviews mention “supportive consulting” and highlight the “transparent process”. |

Earnest

Earnest offers a streamlined approach to personal lending for self-employed borrowers. The platform is set up to adjust its underwriting to accommodate varied income streams. Its online interface is clear, and the repayment options are designed with simplicity in mind. The consistent approval turnaround coupled with competitive rates stands out in its reviews. Clients find that the application requirements are clearly outlined. This objective process is refined by data that tracks applicant performance and repayment behavior, giving Earnest an edge in clarity and user orientation.

Interest Rates: 4.99% – 24.99%

Loan Range: $2K – $50K

Approval Speed: 1-2 Days

Approval for Self Employed: High

Customer Service: 4.6/5

| Summary of Online Reviews |

|---|

| Users express “satisfaction with clear terms” and mention “quick digital responses”. |

Final Thoughts

Self-employed borrowers have many clear options in 2025. Each provider shows strengths in rate competitiveness, approval speed, and customized loan ranges. Decision makers should compare detailed criteria like interest rates, loan limits, and customer support to select the best fit. Businesses seeking dependable funding may benefit from a lender that clearly aligns with their financial documentation and income irregularity. The ratings and detailed overviews in this ranking help point to the most reliable sources for personal loans in today’s market.