July 28, 2025

Last Updated: July 28, 2025

This list helps self-employed professionals find dependable income protection. The selection focuses on providers that offer a range of plans to secure earnings during illness or injury. The list reflects detailed research with verified data and user feedback. The evaluation considers factors that affect both plan security and customer trust. The criteria used to assess each company include:

- Coverage Options

- Plan Flexibility

- Customer Service

- Pricing

- Claim Settlement Speed

- Financial Stability

Top 10 Income Protection Companies For Self Employed In 2025

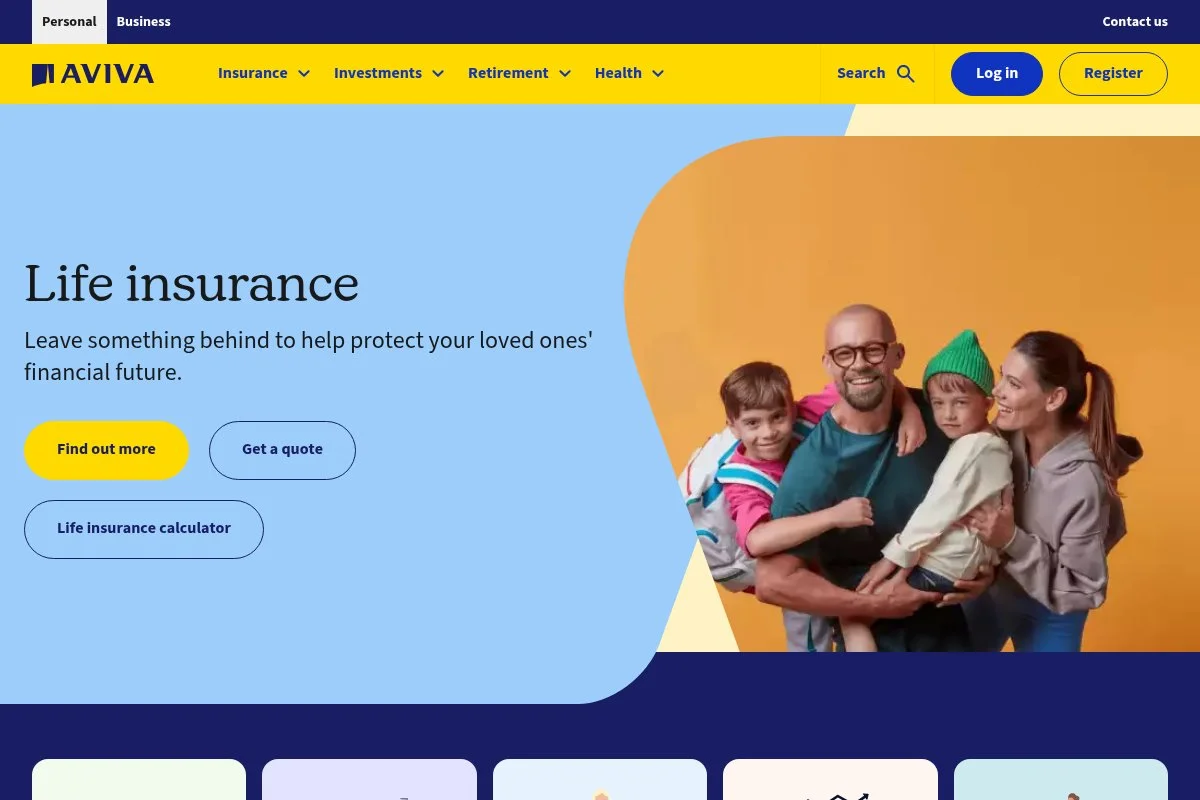

Aviva

Aviva offers strong policies for professionals who work for themselves. Their plans feature extensive coverage paired with flexible terms. Many users report clarity in policy details and a straightforward claim process. Aviva supports a variety of income protection products that adjust to changes in work patterns. The plans are built for long-term reliability and prompt service. Detailed product support helps clients understand policy benefits.

Coverage Options: Extensive

Plan Flexibility: High

Customer Service: Reliable

Pricing: Moderate

Claim Settlement Speed: Fast

Financial Stability: Strong

| Summary of Online Reviews |

|---|

| Users noted, “**The claim process was simple and quick.**” Many appreciate the clear coverage details. |

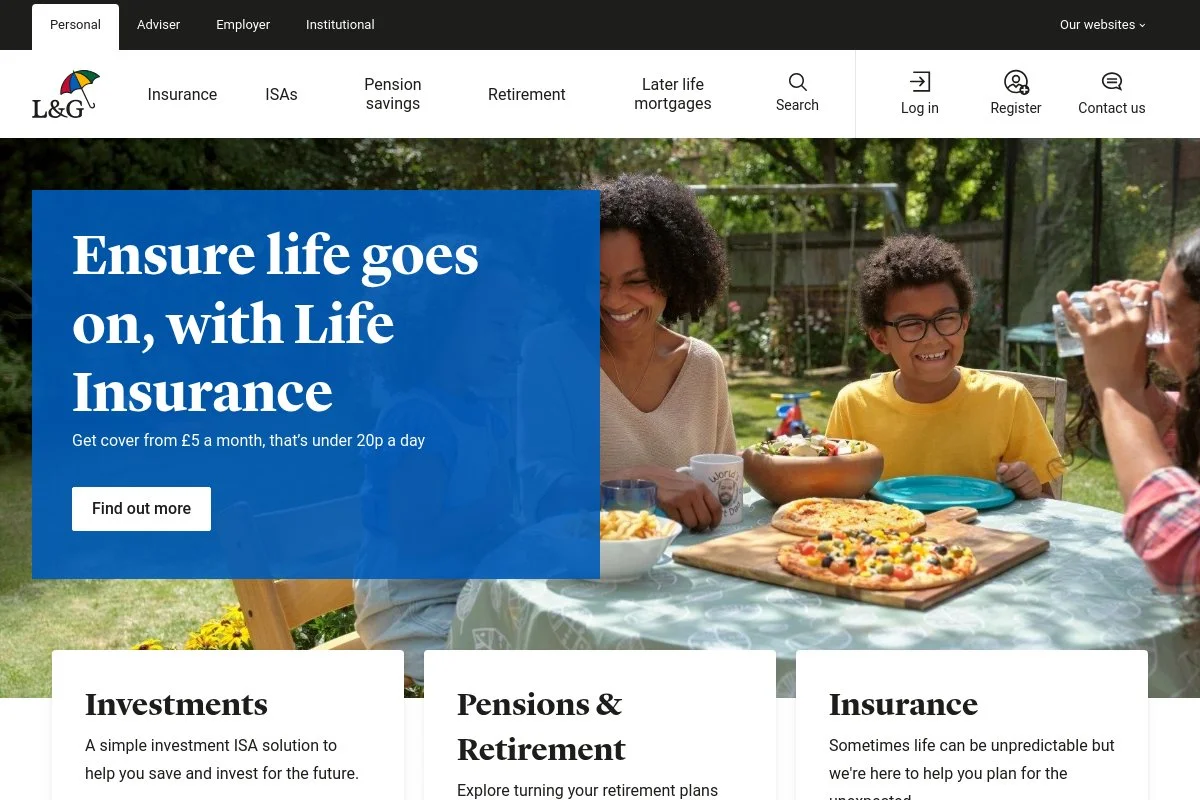

Legal & General

Legal & General provides income protection policies that meet diverse needs. They design plans that adjust to income fluctuations for self-employed individuals. Clients enjoy clear policy frameworks and supportive customer care. The company stands out for its competitive pricing and steady service. Their claim process is efficient and transparent. The policies offer fit-for-purpose coverage that supports fluctuating careers.

Coverage Options: Very Good

Plan Flexibility: High

Customer Service: Responsive

Pricing: Moderate

Claim Settlement Speed: Quick

Financial Stability: Excellent

| Summary of Online Reviews |

|---|

| Clients mention, “**Pricing is competitive and the process is hassle-free.**” Satisfaction is high. |

Royal London

Royal London offers solid income protection options tailored to self-employed groups. Their policies provide reliable cover with practical conditions. Reviews show a balanced mix of coverage and pricing. Their support team is known to offer clear assistance during claim processes. The product range caters to professionals seeking steady earning protection. The service and claim management processes receive positive feedback.

Coverage Options: Excellent

Plan Flexibility: Medium

Customer Service: Efficient

Pricing: Competitive

Claim Settlement Speed: Steady

Financial Stability: High

| Summary of Online Reviews |

|---|

| Users express, “**The coverage is great and customer support is helpful.**” Consistency is valued. |

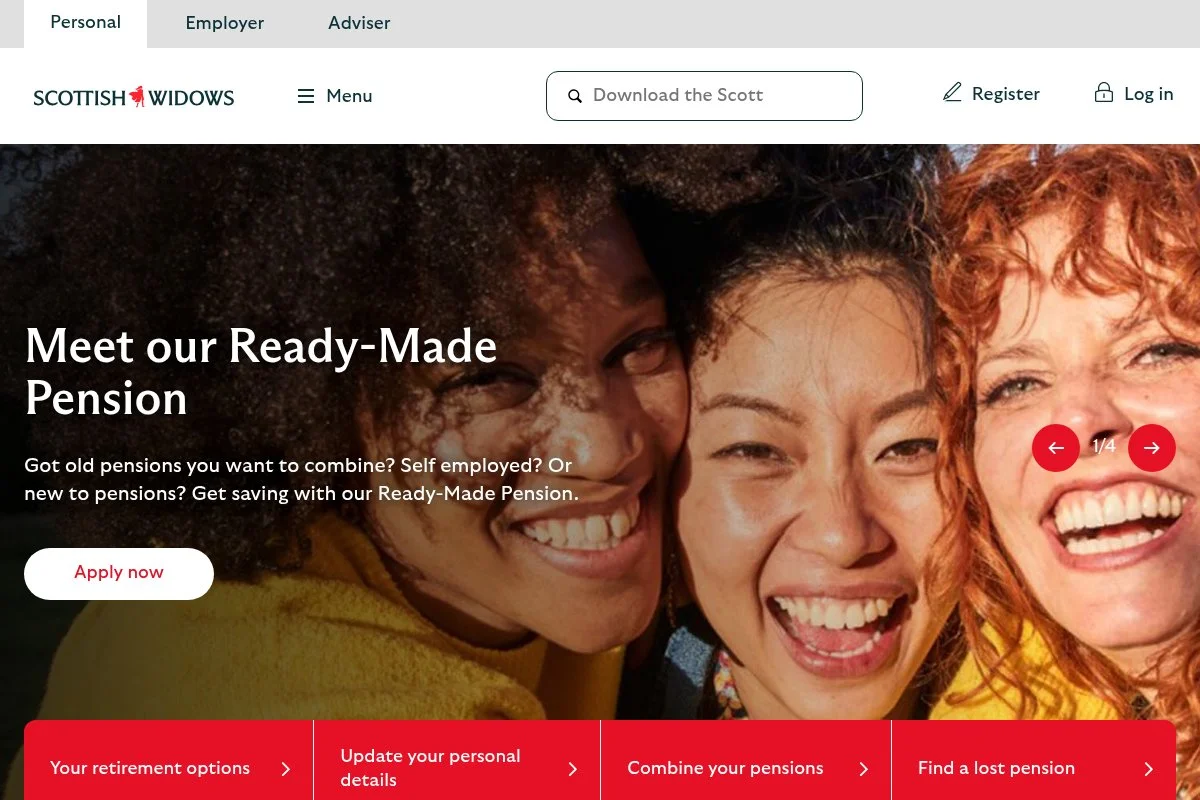

Scottish Widows

Scottish Widows offers plans aimed at maintaining income during unexpected events. Their policies focus on ease of use and straightforward claims. Clients appreciate clear documentation and responsive support teams. The plans are designed to meet the needs of self-employed individuals. Policy options are clear and adjusted to modern risks. The firm stands as a trusted source for steady income cover.

Coverage Options: Good

Plan Flexibility: Medium

Customer Service: Attentive

Pricing: Competitive

Claim Settlement Speed: Reliable

Financial Stability: Solid

| Summary of Online Reviews |

|---|

| Feedback includes, “**The policy details are clear and the team is supportive.**” Many trust their service. |

LV=

LV= provides policies that cater to the varied needs of the self-employed. Their approach stresses easy-to-understand terms and secure coverage. Feedback shows that customers value transparent pricing and effective support. The plans are crafted to meet shifting income patterns with practical features. Clients enjoy balanced protection and clear terms in every policy.

Coverage Options: Good

Plan Flexibility: High

Customer Service: Courteous

Pricing: Moderate

Claim Settlement Speed: Timely

Financial Stability: Reliable

| Summary of Online Reviews |

|---|

| Reviews show, “**The policy is clear and the support team answers queries quickly.**” Users express consistent satisfaction. |

Vitality

Vitality focuses on plans that adjust with a client’s career. Their policies are built for flexibility and steady income support. Customers point out that the pricing remains fair while offering varied options. The support team delivers clear guidance during claims and routine inquiries. This provider meets the requirements of individuals running their own business.

Coverage Options: Good

Plan Flexibility: High

Customer Service: Responsive

Pricing: Moderate

Claim Settlement Speed: Efficient

Financial Stability: Steady

| Summary of Online Reviews |

|---|

| Customers state, “**Vitality provided flexible options that suit my varied work schedule.**” Value is seen in responsiveness. |

Aegon

Aegon offers policies that cater to steady income protection with clear terms. Their plans work well for self-employed individuals seeking reliable cover. The support systems are designed to handle claims promptly. Many users appreciate the clarity in terms and easy adjustments over time. Aegon ranks highly in financial strength and offers fair pricing for its services.

Coverage Options: Sufficient

Plan Flexibility: Medium

Customer Service: Steady

Pricing: Competitive

Claim Settlement Speed: Moderate

Financial Stability: Strong

| Summary of Online Reviews |

|---|

| Feedback includes, “**Claims were resolved efficiently and the policy is clear.**” Users feel supported. |

Zurich

Zurich offers stable income protection plans with a focus on balanced coverage. Their policies support clients during difficult times. The approach is clear and built on trust. Zurich provides steady options and fair pricing for its services. Feedback often mentions the dependable support and organized claim process. Their offerings suit self-employed professionals looking for continuous coverage.

Coverage Options: Adequate

Plan Flexibility: Medium

Customer Service: Consistent

Pricing: Moderate

Claim Settlement Speed: Steady

Financial Stability: Secure

| Summary of Online Reviews |

|---|

| Users mention, “**Steady and clear services with fair pricing.**” Trust is a common theme. |

Principality

Principality offers plans that suit self-employed professionals seeking steady earnings support. Their policies feature clear terms. The plan options meet basic income protection needs. Customers value the straightforward approach and affordable costs. The service is tuned to respond efficiently during claim requests. Principality is preferred for its balance between coverage and price.

Coverage Options: Sufficient

Plan Flexibility: Medium

Customer Service: Approachable

Pricing: Affordable

Claim Settlement Speed: Reliable

Financial Stability: Stable

| Summary of Online Reviews |

|---|

| Reviews state, “**Simple and affordable coverage with dependable service.**” Value lies in clarity. |

Canada Life

Canada Life supports self-employed individuals with steady income protection plans at accessible rates. Their policies are structured to suit various career paths. The company offers clear information and respectful customer support. Users find their guidelines easy to follow and appreciate the direct approach to claims. The insurer focuses on affordability without compromising service standards.

Coverage Options: Adequate

Plan Flexibility: Medium

Customer Service: Responsive

Pricing: Affordable

Claim Settlement Speed: Efficient

Financial Stability: Steady

| Summary of Online Reviews |

|---|

| Clients shared, “**Clear policies and affordable plans made managing risks easier.**” Users highlight ease and value. |

Final Thoughts

The list shows varied strengths among providers that support income protection for self-employed individuals. Each company meets specific needs with clear terms and tailored plans. Readers are encouraged to consider factors like plan flexibility and claim speed when choosing a provider. Selecting one depends on individual work patterns and financial goals. Data-backed evaluations guide a balanced decision that fits diverse circumstances.