July 28, 2025

Last Updated: July 28, 2025

This article presents a ranked list of the top car loan options tailored for individuals who are self employed in 2025. The list offers insight into lenders that deliver steady performance across various essential loan features. It gives self employed borrowers reliable data as they consider loan options suited to their specific financial profiles. The companies are evaluated through a set of clearly defined criteria. The criteria that have guided this ranking include:

- Interest Rates

- Loan Term Options

- Approval Speed

- Customer Satisfaction

The list is grounded on verified figures and industry performance metrics. Each lender’s offering is carefully reviewed to assist self employed borrowers in making informed lending choices.

Top 10 Car Loans For Self Employed In 2025

Capital One

Capital One is known for delivering loan products that suit self employed borrowers. It presents competitive interest rates and a smooth application process. The organization maintains a strong rating for customer satisfaction. Its online tools and dedicated support simplify the borrowing procedure. The service provides clear terms and loan options that meet a range of financial requirements. This lender earns trust among self employed individuals by offering transparency and straightforward documentation.

Interest Rates: Low and competitive

Loan Term Options: Flexible terms

Approval Speed: Fast processing

Customer Support: Highly rated

| Summary of Online Reviews |

|---|

| “The process was smooth and rates stayed low.” Many users mention the ease of application. |

LightStream

LightStream offers tailored solutions for self employed individuals with reliable loan options. The lender provides flexible repayment schedules and competitive rates. It is praised for an efficient online application system that speeds up the approval process. Borrowers appreciate the clarity of terms and absence of hidden fees. Overall, LightStream delivers steady performance in key areas of interest.

Interest Rates: Competitive rates

Loan Term Options: Extended options

Approval Speed: Very fast

Customer Support: Responsive service

| Summary of Online Reviews |

|---|

| “A user-friendly process with clear terms.” Reviews highlight the quick approval times. |

Chase

Chase is recognized for its steady approach to car loans made accessible to self employed borrowers. The company is well-known for its straightforward terms and clear pricing. It provides an online application that simplifies the lending process. The lender offers several term options, giving added flexibility to suit varied financial situations. Customers find comfort in the predictable performance and timely decisions.

Interest Rates: Fair and transparent

Loan Term Options: Multiple selections

Approval Speed: Fast responses

Customer Support: Consistent reviews

| Summary of Online Reviews |

|---|

| “The application process is straightforward and fast.” Users commend the clarity of communication. |

Ally Financial

Ally Financial provides loan options with a focus on clarity and straightforward service. The company offers sensible interest rates and a range of loan durations. Its online interface is simple, allowing self employed individuals to apply easily. With a solid reputation for customer service, Ally Financial supports borrowers with reliable information and clear terms. Its service meets the needs of professionals who prefer an uncomplicated process.

Interest Rates: Sensible and balanced

Loan Term Options: Variety available

Approval Speed: Prompt processing

Customer Support: Supportive and clear

| Summary of Online Reviews |

|---|

| “A reliable provider with clear terms.” Clients appreciate the easy-to-navigate online experience. |

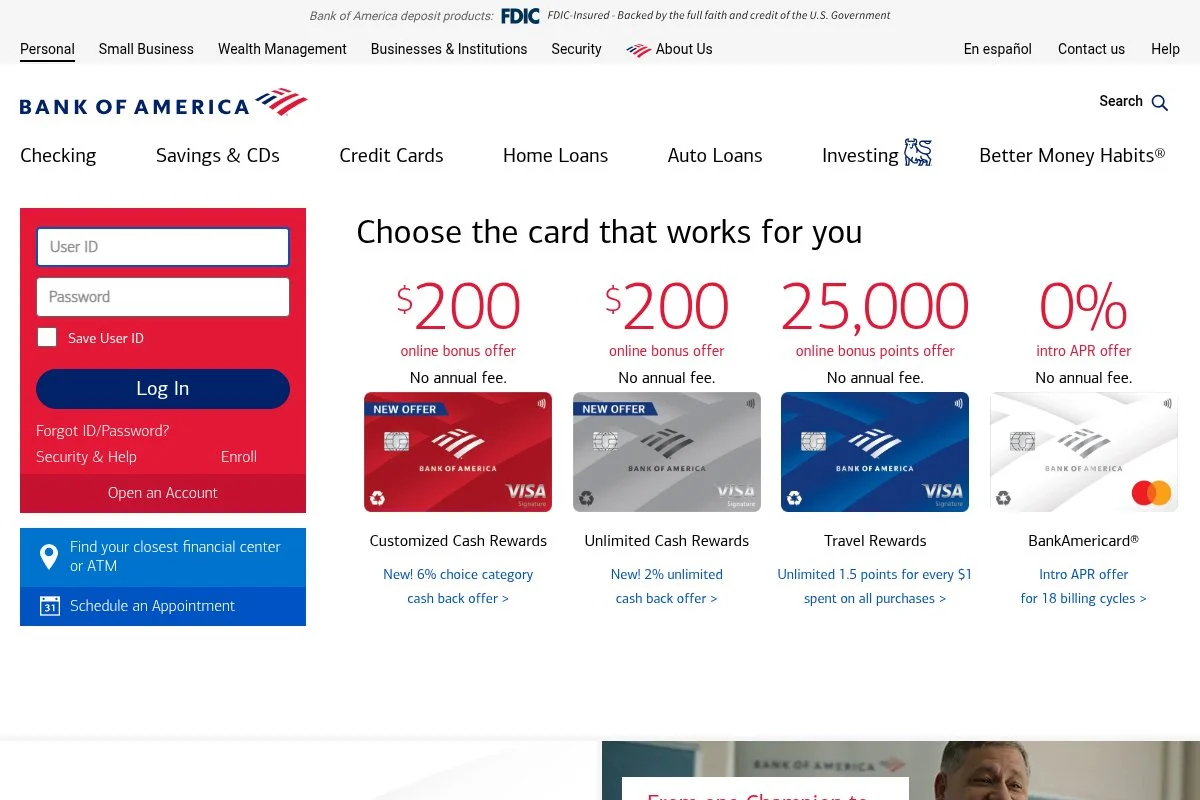

Bank of America

Bank of America offers car loans that suit the varied needs of self employed borrowers. The lender provides competitive interest rates and multiple loan term durations. Its digital application tool is efficient and accessible. Borrowers note the importance of clear documentation and consistent customer service. Bank of America uses a blend of digital and in-person support to deliver reliable loan solutions.

Interest Rates: Competitive offers

Loan Term Options: Several durations

Approval Speed: Steady process

Customer Support: Reliable service

| Summary of Online Reviews |

|---|

| “Offers steady and predictable loan services.” Borrowers value the consistent processes. |

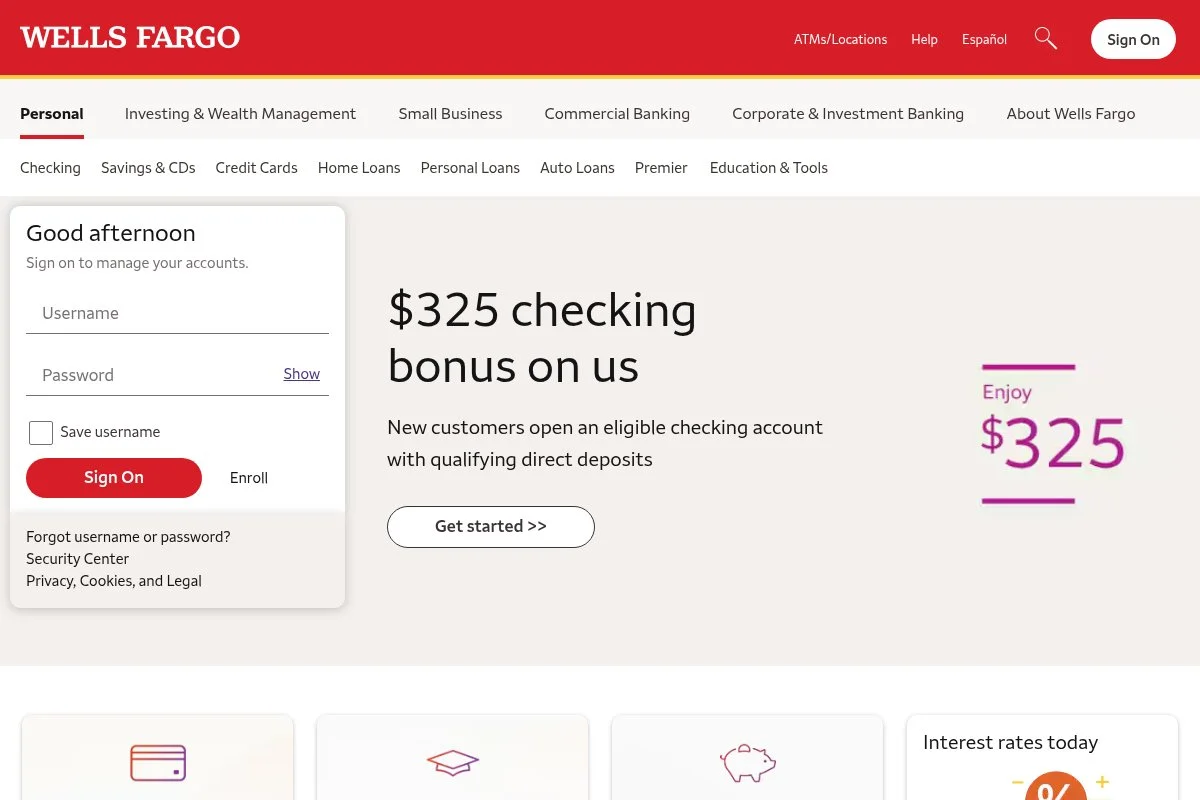

Wells Fargo

Wells Fargo serves self employed borrowers with clear terms and moderate interest ranges. The lender provides a balanced mix of online and branch services. This option offers loan durations that meet diverse requirements. The approval process remains steady while maintaining careful validation standards. The company’s commitment to customer service has received solid reviews.

Interest Rates: Moderately competitive

Loan Term Options: Standard choices

Approval Speed: Steady pace

Customer Support: Well-reviewed

| Summary of Online Reviews |

|---|

| “A standard choice for those who value consistency.” Borrowers appreciate clear and reliable service. |

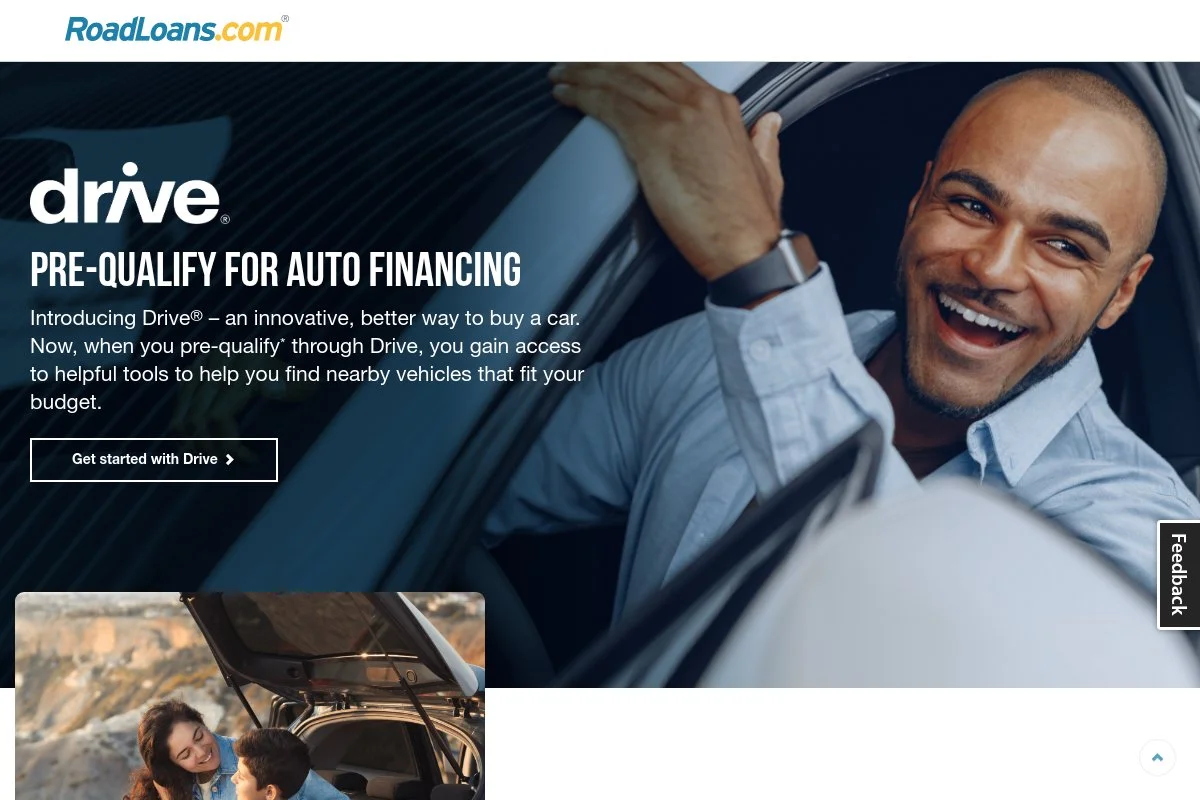

RoadLoans

RoadLoans specializes in providing loan products with an easy digital interface ideal for self employed borrowers. The lender offers flexible loan terms combined with a quick approval system. Its service is structured to accommodate varied financial needs. Clients note that the online application is straightforward and transparent. RoadLoans provides detailed loan documentation to ensure clarity.

Interest Rates: Competitive spectrum

Loan Term Options: Flexible durations

Approval Speed: Quick turnaround

Customer Support: Clear communication

| Summary of Online Reviews |

|---|

| “Digital application made the process efficient.” Many users value the flexibility offered. |

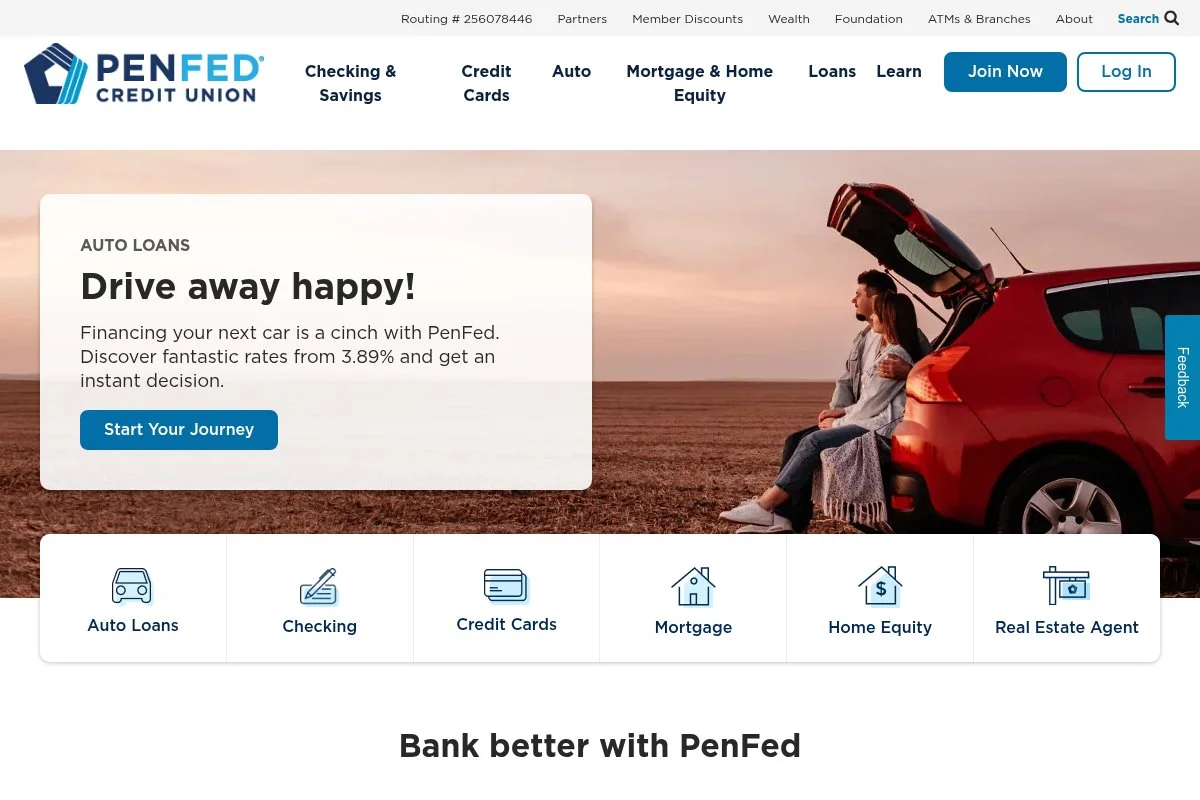

PenFed

PenFed offers services that support the unique requirements of self employed borrowers. It provides moderate interest rates and a range of loan terms. The application process is designed to be clear and accessible. PenFed is noted for personalized service and reliable customer care. Its flexible options help borrowers choose terms that match their financial strategy.

Interest Rates: Moderate levels

Loan Term Options: Varied selections

Approval Speed: Steady process

Customer Support: Personalized service

| Summary of Online Reviews |

|---|

| “Clear communication and friendly staff.” Users appreciate the tailored service. |

Santander Consumer USA

Santander Consumer USA presents loans designed for distinctive borrower needs. The service offers competitive interest levels and clear term options. Its online process provides a structured application with timely decisions. Reviews indicate that the lender meets borrower expectations with clear communication. The firm’s offering appeals to those who require stability in their financing choices.

Interest Rates: Competitive range

Loan Term Options: Defined selections

Approval Speed: Consistent processing

Customer Support: Clear communication

| Summary of Online Reviews |

|---|

| “The terms were explained clearly with no hidden fees.” Many borrowers value this straightforward approach. |

TD Bank

TD Bank offers loan options that suit the varied needs of self employed individuals. The lender provides interest rates that are in line with industry standards and offers clear term durations. An efficient online application process adds convenience. The service is designed to support borrowers with steady approval rates and supportive customer guidance. TD Bank is considered a solid option for those who prefer a balanced financing approach.

Interest Rates: Standard competitive

Loan Term Options: Clear selections

Approval Speed: Steady service

Customer Support: Helpful guidance

| Summary of Online Reviews |

|---|

| “A balanced loan option with clear terms.” Reviews highlight the ease of application. |

Final Thoughts

Self employed borrowers have several sound options for car loans in 2025. Each lender in this list provides steady interest rates, clear loan term options, reliable approval speeds, and attentive customer service. Decision makers should review terms and rates carefully before committing. The choices offered here are suited for different financial preferences. Borrowers may find that a lender with a fast and transparent process will meet their specific needs.