July 28, 2025

Last Updated: July 28, 2025

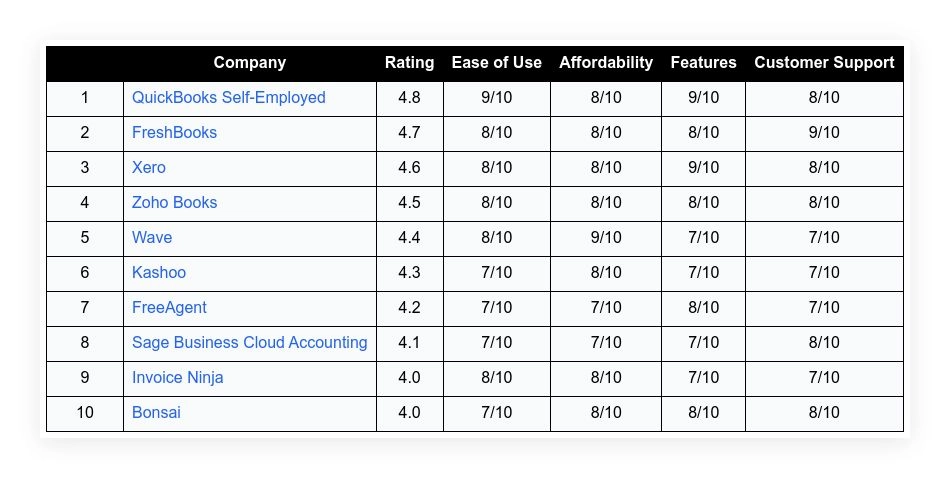

This list is designed to help self-employed professionals find the ideal accounting software to support their business needs in 2025. The article offers a ranked guide that compares performance metrics to assist with making a well-informed decision. It provides background details on each tool’s performance in managing invoices, tracking expenses, and tax management. The evaluation criteria have been carefully chosen to reflect business priorities. The criteria include:

- Ease of Use

- Affordability

- Features

- Customer Support

- Integration Capabilities

The ranking uses verified data and user reviews to ensure a fair assessment. Each tool offers a unique blend of cost-effectiveness and utility for managing business finances. The following table and breakdown will present detailed insights into each accounting solution.

Top 10 Accounting Software For Self Employed In 2025

QuickBooks Self-Employed

QuickBooks Self-Employed is a preferred solution for freelancers and independent contractors. It supports tax calculations and offers easy mileage tracking. The platform provides tools that streamline invoice management and expense categorization. The user interface is simple, which helps in quick adoption and effective tracking of finances. The software delivers real-time updates on tax obligations and provides personalized expense reports. Its design enables professionals to dedicate more time to growing their business rather than managing complex financial data.

Ease of Use: 9/10

Affordability: 8/10

Features: 9/10

Customer Support: 8/10

Integration: High

| Summary of Online Reviews |

|---|

| Users report that the interface is incredibly clear with prompt support during tax season. |

FreshBooks

FreshBooks is known for its ease in managing invoices and tracking time. The platform is favored by self-employed professionals for its straightforward design. It offers a range of financial management tools that simplify daily accounting tasks. The software also supports multiple currencies and comprehensive reporting. Its dashboard is made to provide instant data, which helps in making timely decisions. The service also provides automation features that reduce repetitive manual tasks and increase productivity.

Ease of Use: 8/10

Affordability: 8/10

Features: 8/10

Customer Support: 9/10

Integration: Moderate

| Summary of Online Reviews |

|---|

| Clients mention it as intuitive and efficient with good value for growing businesses. |

Xero

Xero delivers a balanced mix of functionality and user-friendliness. It is equipped with tools for expense management and cash flow monitoring. The interface allows self-employed users to connect their bank accounts and streamline payments. The tool provides comprehensive reporting that helps in understanding financial performance. Xero is well known for its dashboard, which emphasizes clarity and efficiency for on-the-go management. Its ability to integrate with a variety of other applications adds extra value by automating multiple tasks.

Ease of Use: 8/10

Affordability: 8/10

Features: 9/10

Customer Support: 8/10

Integration: High

| Summary of Online Reviews |

|---|

| Users value its clear layout and versatile integration options. |

Zoho Books

Zoho Books offers a solid suite of accounting tools tailored for independent professionals. It provides intuitive expense tracking and invoice management. The design emphasizes simplicity, making it easy to navigate for newcomers. The platform also enables smart automation, reducing manual data entry. Users benefit from real-time financial insights that help in planning and decision-making. Its capacity to integrate with a host of third-party applications makes it a versatile choice. Overall, Zoho Books stands out for its balanced performance across basic and advanced accounting tasks.

Ease of Use: 8/10

Affordability: 8/10

Features: 8/10

Customer Support: 8/10

Integration: Moderate

| Summary of Online Reviews |

|---|

| Many appreciate its streamlined workflows and consistent updates. |

Wave

Wave stands out due to its no-cost basic accounting services which suit beginners and small operators very well. It includes features that manage invoicing, receipts, and bank reconciliations. The tool is straightforward and reduces the strain of accounting tasks. Even though the free service may have limits on advanced features, many users enjoy the reliability it offers for everyday bookkeeping. Wave also integrates with several external applications, supporting a smoother workflow for self-employed professionals. Its budget-friendly approach and simple design maintain its appeal among many users.

Ease of Use: 8/10

Affordability: 9/10

Features: 7/10

Customer Support: 7/10

Integration: Moderate

| Summary of Online Reviews |

|---|

| Users mention it as cost-effective and efficient with satisfactory basic features. |

Kashoo

Kashoo offers intuitive accounting designed for small business owners managing their own books. This tool simplifies expense tracking and invoice management. It provides an interface that is both clear and efficient. The service includes useful reporting features for monitoring overall financial health. Users value the practical design and straightforward functionality, which cuts down on administrative tasks. The application suits professionals who need a reliable and user-focused service without overwhelming options.

Ease of Use: 7/10

Affordability: 8/10

Features: 7/10

Customer Support: 7/10

Integration: Basic

| Summary of Online Reviews |

|---|

| Reviews highlight its simple navigation and no-fuss support. |

FreeAgent

FreeAgent is well-suited for freelancers needing a tailored accounting system. It provides a variety of features to track project expenses, invoices, and taxes. The dashboard is intuitive and offers real-time insights into financial standing. The tool also has strong scheduling functions to help with recurring payments. FreeAgent is designed with the self-employed in mind, ensuring that time spent on accounting is minimized. The experience is user-friendly and supports quick adjustments as the business grows.

Ease of Use: 7/10

Affordability: 7/10

Features: 8/10

Customer Support: 7/10

Integration: Moderate

| Summary of Online Reviews |

|---|

| Customers state it is efficient for freelancers with responsive service. |

Sage Business Cloud Accounting

Sage Business Cloud Accounting provides essential financial management for independent professionals. It offers a structured approach to bookkeeping with modular tools for invoicing and payroll. The system is designed with ease of navigation in mind, making it accessible for users without extensive accounting knowledge. Sage focuses on clear financial insights that help in decision-making. Besides, its cloud-based system ensures data is secure and available from various devices. The service delivers steady performance that supports daily financial operations with consistent accuracy.

Ease of Use: 7/10

Affordability: 7/10

Features: 7/10

Customer Support: 8/10

Integration: Moderate

| Summary of Online Reviews |

|---|

| Users find the software dependable for routine tasks with clear reporting. |

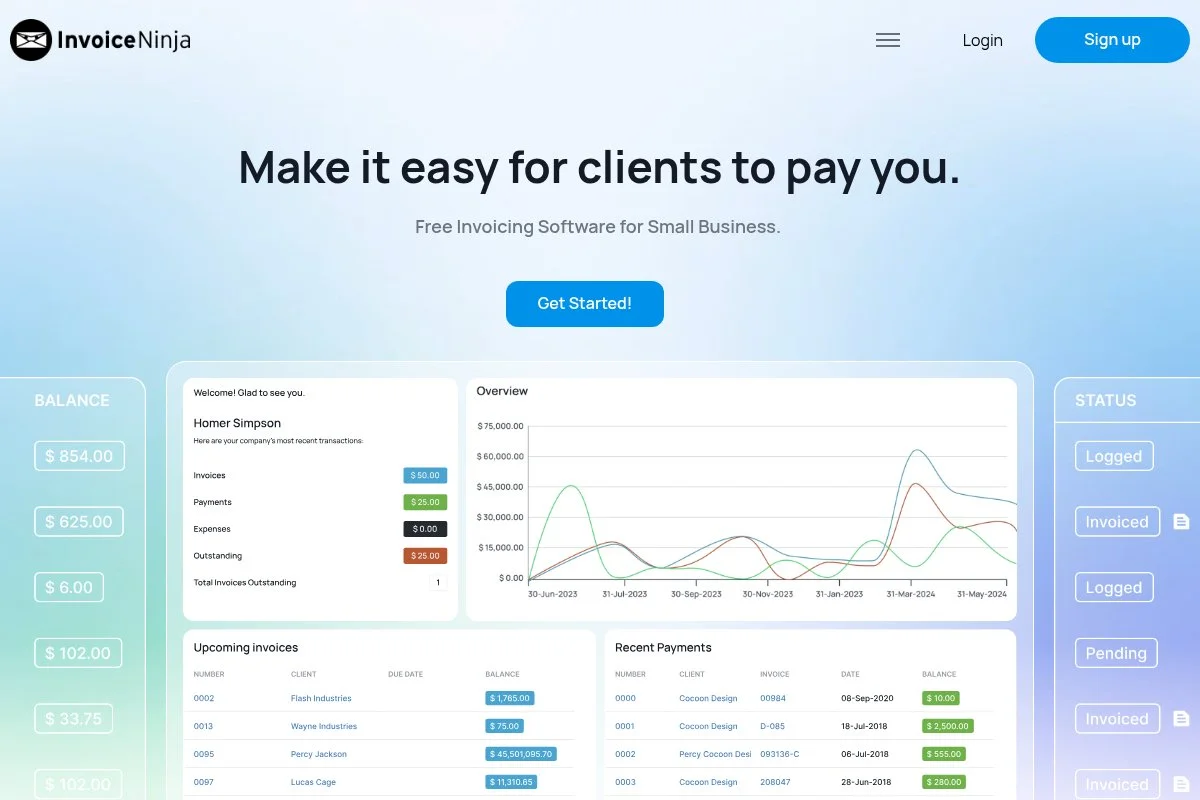

Invoice Ninja

Invoice Ninja stands as a handy tool for invoice management and payment tracking. It targets self-employed professionals with its customizable invoice templates and automated reminders. The application simplifies billing procedures and reduces manual errors. With a user-friendly dashboard, essential data is easily accessible. The tool also integrates with various payment gateways, making transactions efficient. The design is clear and responds quickly to updates, which streamlines financial operations for individuals juggling multiple roles.

Ease of Use: 8/10

Affordability: 8/10

Features: 7/10

Customer Support: 7/10

Integration: High

| Summary of Online Reviews |

|---|

| Clients note its efficient invoicing and smooth integrations with payment systems. |

Bonsai

Bonsai is crafted for freelancers who need not only accounting but also project management support. It helps in invoice creation, contract management, and expense tracking. The interface is designed to reduce time spent on paperwork. Bonsai automates many tasks that are common for solo professionals. The tool supports a range of workflows typical in creative and digital work. Its scheduling and reminder features assist in maintaining regular cash flow. This combination of accounting and workflow management makes it a favored choice among self-employed individuals.

Ease of Use: 7/10

Affordability: 8/10

Features: 8/10

Customer Support: 8/10

Integration: Moderate

| Summary of Online Reviews |

|---|

| Reviews show users appreciate the integrated task management and easy invoicing system. |

Final Thoughts

Self-employed professionals have several effective options for overseeing their finances in 2025. The tools presented each offer distinct advantages whether in ease of use, affordability, or broad functionality. The selection depends on individual business needs and comfort with additional integrations. Evaluating priorities like automation and support levels can help determine the best match. Readers can use this guide to narrow down choices based on verified ratings and user feedback.