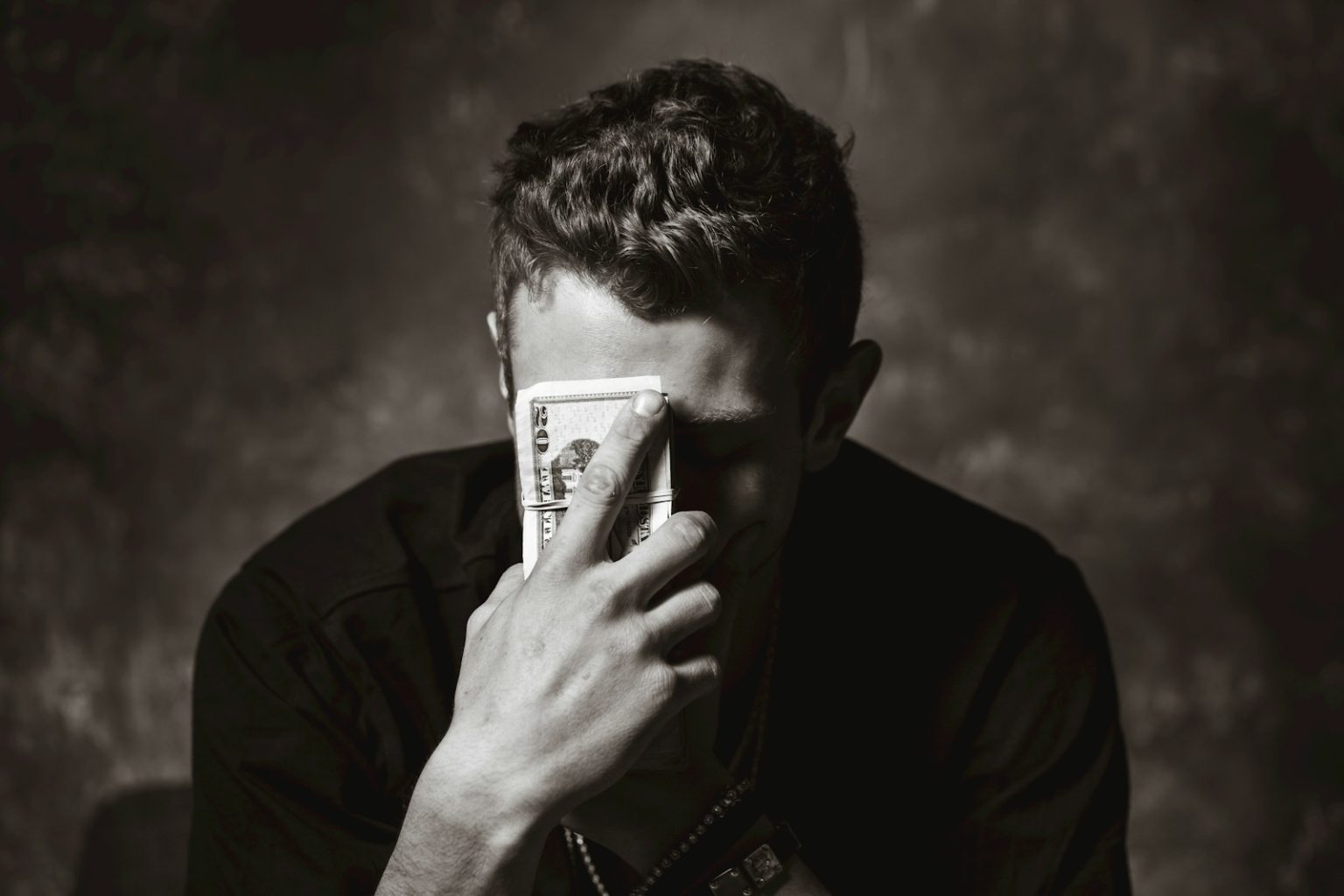

I once had over $100 million to my name. Yet something was profoundly wrong with my relationship to wealth. When my bank account dropped by just $100, I felt like a complete failure. When it increased by the same small amount, I suddenly felt like a winner again. My entire identity had become wrapped up in money — not just having it, but watching its every movement as if it were the scoreboard of my life.

This unhealthy obsession with wealth wasn’t obvious to me at the time. I was successful by society’s standards. I had achieved what many people dream of. But inside, I was trapped in a cycle of validation that depended entirely on financial metrics.

The Identity Trap

Looking back, I can see how I had allowed money to become my entire identity. Every decision, every relationship, every moment of joy or pain was filtered through the lens of financial gain or loss. I wasn’t living as a person – I was living as a balance sheet.

This mindset created a paradoxical situation: I had enormous wealth but couldn’t enjoy it. A minor fluctuation in my accounts could ruin my entire day. The psychological burden was immense, yet I couldn’t see beyond it.

View this post on Instagram

The Universe’s Intervention

Then came what I now recognize as the universe’s intervention. It was as if life itself decided I needed to learn a fundamental lesson about what truly matters. The message was clear: “Maybe you should live this life and learn something, like money doesn’t buy love or happiness. It just allows you to shop, and maybe we take everything away and you’ll learn to shop for the right thing.”

And that’s exactly what happened. I lost it all. What seemed like a catastrophe at the time was actually the most valuable lesson of my life.

What Money Actually Provides

Through this experience, I’ve come to understand what money actually does and doesn’t do:

- Money doesn’t create happiness – it only enables transactions

- Money doesn’t generate love – it can sometimes even complicate relationships

- Money doesn’t provide meaning – that comes from within and from how we serve others

- Money doesn’t define your worth – your character and impact do

The simple truth is that money is just a tool. It allows us to shop — to make choices and purchases. But if we don’t know what we’re shopping for, or if we’re shopping for the wrong things, no amount will ever be enough.

Learning to Shop for the Right Things

When everything was taken away, I had to rebuild not just my finances but my entire value system. I had to learn what was truly worth “shopping” for:

- Meaningful relationships built on authentic connection

- Experiences that create lasting memories

- Opportunities to grow and learn

- Ways to contribute to others’ well-being

- Inner peace and contentment

These are the things that actually create happiness and fulfillment. They can’t be purchased directly, but they can be cultivated when we direct our resources — including money — toward what genuinely matters.

The Freedom of Letting Go

There’s an incredible freedom that comes with breaking the link between your identity and your bank account. When you no longer measure your worth by your wealth, you can finally enjoy both life and money for what they truly are.

Today, I understand that dollars don’t determine my value. My happiness isn’t dependent on financial growth. And my purpose isn’t to accumulate wealth but to use whatever resources I have — financial and otherwise — to create meaning and positive impact.

The universe gave me a costly but necessary lesson. By taking everything away, it showed me what was truly valuable. And for that, I’m grateful beyond words.

Frequently Asked Questions

Q: How did losing your wealth change your perspective on success?

Losing everything forced me to redefine success completely. I transitioned from measuring success solely in financial terms to viewing it as a combination of meaningful relationships, personal growth, positive impact, and inner peace. Money is now just one tool among many, not the scorecard of my life.

Q: What practical steps can someone take to avoid tying their identity to money?

Start by defining your values independent of financial metrics. Practice gratitude for non-monetary aspects of your life—set goals related to experiences, relationships, and personal growth. Regularly ask yourself what you’d still care about if all your money disappeared tomorrow. And consider working with a coach or therapist to explore your relationship with wealth.

Q: Can money contribute to happiness in any way?

Yes, but indirectly. Money provides security and options, which can reduce stress and increase freedom. It can fund experiences that bring joy and enable generosity toward others. However, research consistently shows that beyond meeting basic needs, additional wealth produces diminishing returns on happiness. The key is using money as a tool aligned with your values rather than seeing it as the goal itself.

Q: How do you maintain a healthy relationship with money after experiencing both extreme wealth and loss?

I maintain perspective by regularly practicing gratitude and remembering what truly matters. I’ve established clear financial boundaries and priorities aligned with my values. I make decisions based on what brings genuine fulfillment rather than status or accumulation. Most importantly, I separate financial outcomes from my self-worth, recognizing that market fluctuations don’t define me.

Q: What advice would you give to someone currently measuring their worth by their wealth?

First, recognize that this mindset is common but ultimately unsatisfying. Try disconnecting from financial metrics for a period – don’t check your accounts daily. Invest time in relationships and experiences that have nothing to do with money. Explore what you’d still care about if your wealth disappeared. Consider speaking with others who’ve experienced financial loss yet found happiness. Remember that history remembers people for their character and contributions, not their net worth.