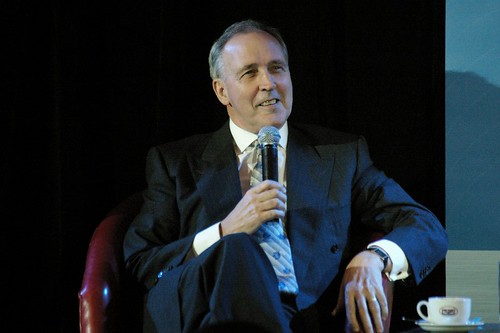

Paul Keating, the former Prime Minister of Australia, has made a bold prediction. He says that young Australians joining the workforce today will have over $3 million in superannuation savings by the time they retire. This is thanks to the compulsory superannuation contribution rate rising to 12% from July 1.

Keating celebrated the increase. He declared the superannuation system has “finally matured” by reaching the 12% contribution rate he envisioned in a 1991 speech. He noted that this growth in personal savings would reduce the reliance on the age pension.

It would drop it to just 2% of GDP by the 2050s. However, not everyone shares his optimism. AMP’s deputy chief economist, Diana Mousina, noted that an average 22-year-old earning $98,000 annually could exceed the $3 million threshold by retirement age.

But the Financial Services Council estimates that only 204,000 workers under the age of 30 will achieve such a balance. This represents less than 5% of this demographic.

Keating’s bold superannuation prediction

Critics argue that while the policy might increase savings significantly, the $3 million figure is not guaranteed. There are also concerns regarding the Australian government’s decision not to index the $3 million threshold to inflation or wage growth. Keating has described this move as “unconscionable.” Despite these concerns, the policy is expected to pass parliament with the support of the Greens.

Keating emphasized the positive impact universal superannuation has had on Australia’s economy. He contrasted it with countries like France, Germany, and the United States. These countries spend significantly more of their GDP on public pensions.

He also highlighted that Australians could have been even better off if the superannuation rate had not been frozen at 9% from 1996 until 2013. This decision was made by John Howard’s government. Keating claims it cost savers between $250,000 and $300,000.

Despite the debates and concerns, the increase to a 12% compulsory superannuation contribution appears set to go ahead. It aims to provide Australians with a more secure financial future as they retire.